Unlimited Blog

At Unlimited® we are experienced investors using machine learning to create products that replicate the index returns of alternative investments.

4Q 2025 Unlimited Hedge Fund Barometer

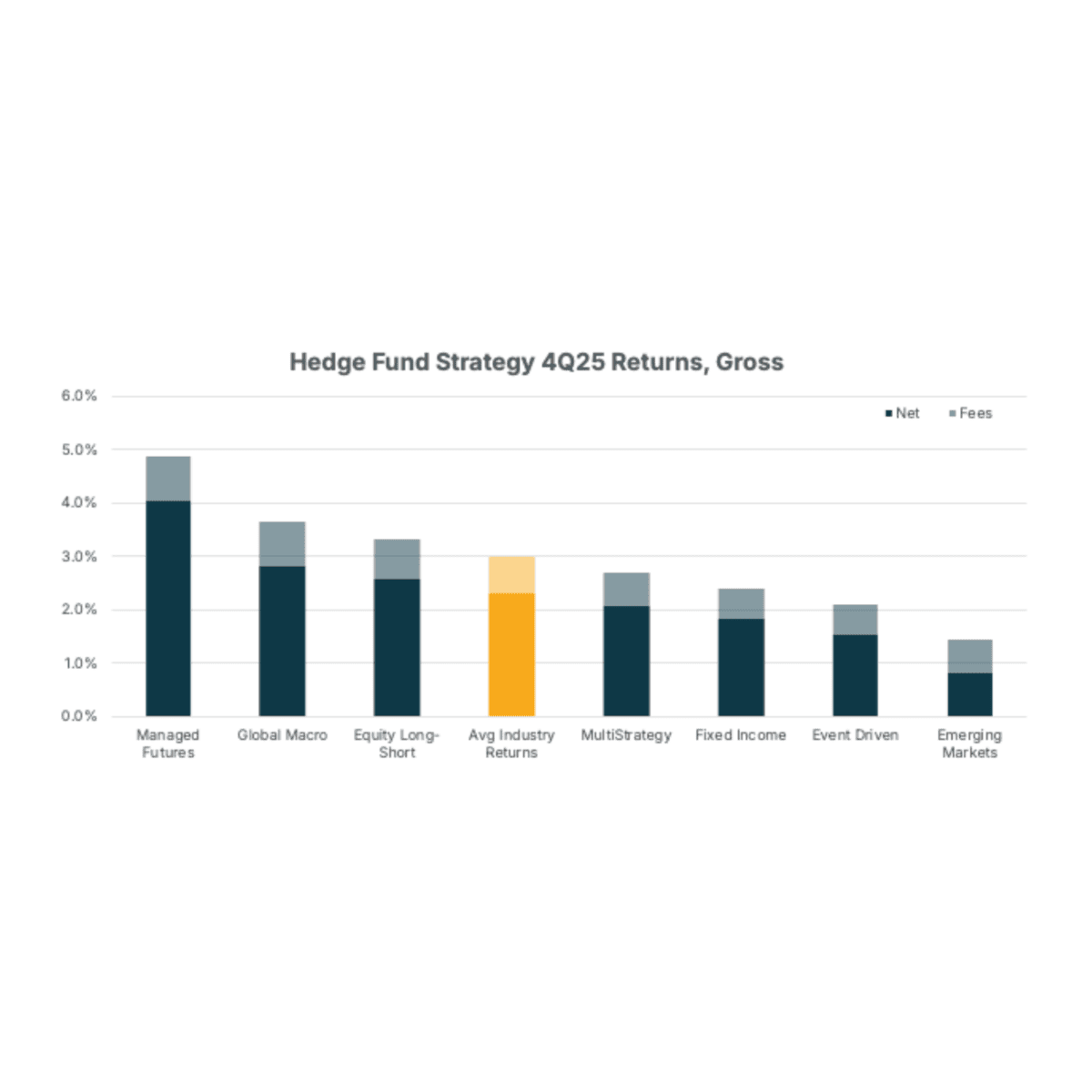

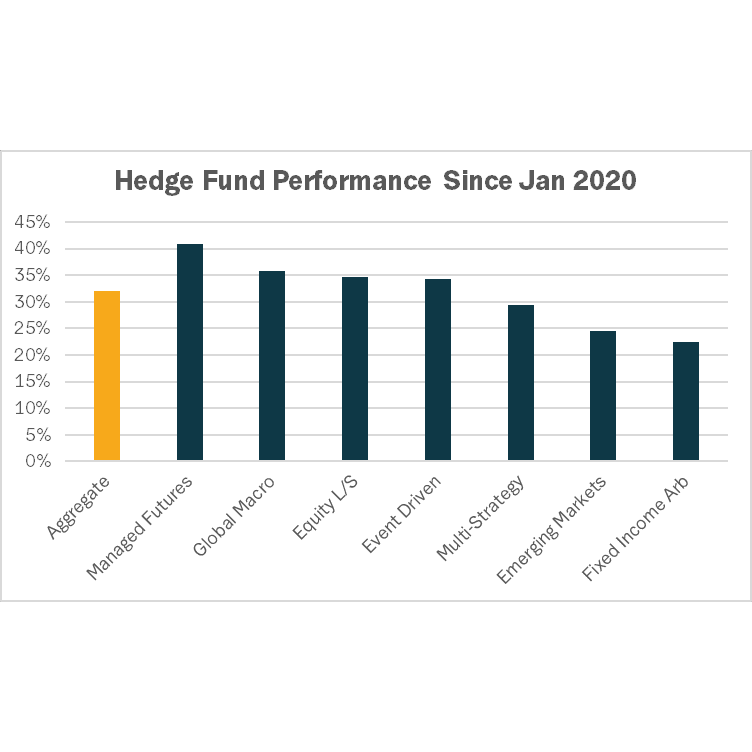

Hedge Funds delivered strong positive performance in Q4-25 with Managed Futures and Global Macro strategies benefitting from rallies in gold and ex-US equities while Emerging Markets strategies were modestly positive, challenged by geopolitical uncertainty.

Top Posts

What’s Under the Hood? What Matters for ETF Liquidity

Understanding the liquidity of an individual stock, bond, or futures contract is…

Harnessing the Wisdom of the Crowd to Mitigate Down-side Risk

Over the past thirty years, hedge funds have proven an uncanny ability to avoid significant down-side risk in equities.

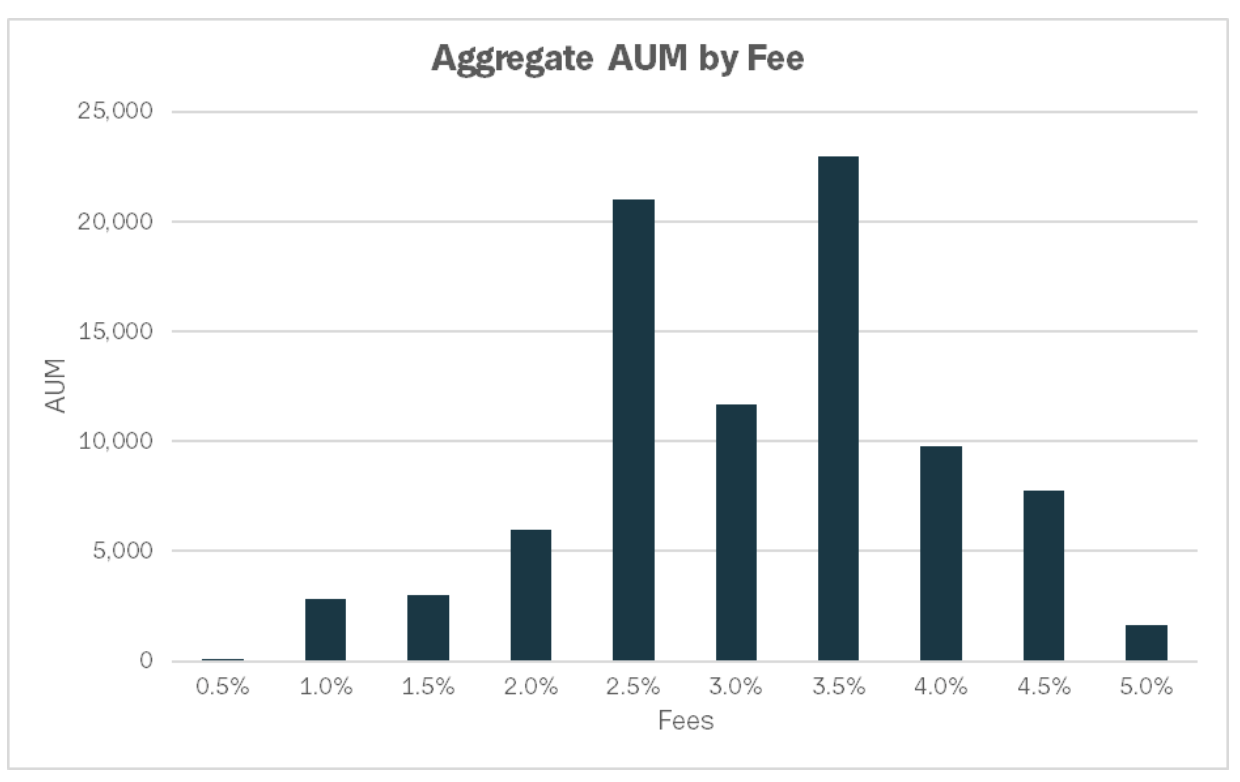

The Fees Are Too Damned High for Most Liquid Alts

Liquid alternatives products often offer the allure of returns that could benefit most…

Imperfect Replication Beats Single Manager Selection 9/10 Times

One of the commonly raised concerns about Hedge Fund replication strategies is the tracking…

Stocks Need Easy Money to Consistently Outperform Hedge Funds

Stock indexes have outperformed hedge funds by quite a bit this year. As of late May, the NASDAQ is…

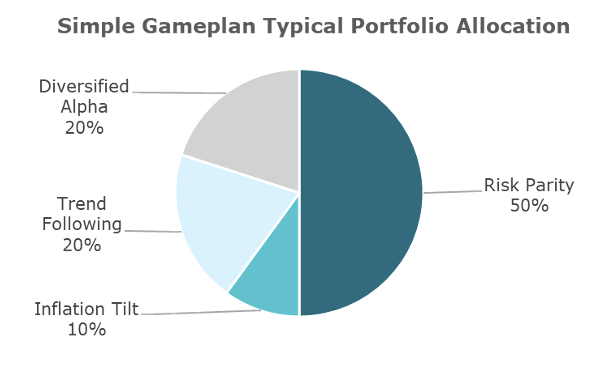

A Simple Investment Gameplan

The last year has all of us wrestling with whether our investment gameplan will work in a wide…

A Couple of Tough Weeks For Hedge Funds

Hedge Funds have experienced some of their worst performance ever over the last couple weeks. Our best estimate of March performance has the industry down roughly 3%, with most of that loss being booked in the last week.

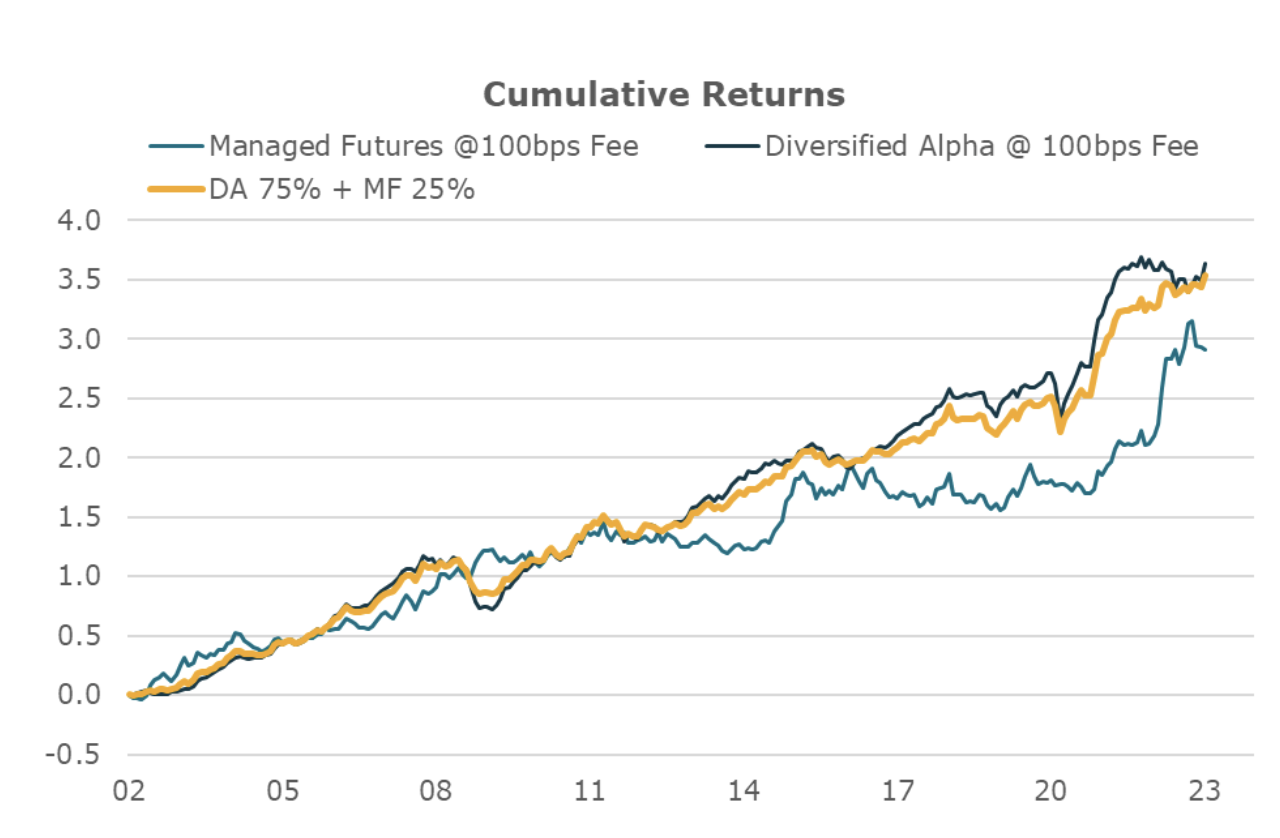

Pairing Managed Futures With Diversified Alpha For More Consistent Return

Many investors are looking at managed futures as an attractive complement for their portfolios…

Improving the Odds With Diversification

Alpha strategies are intended to provide a differentiated return stream from stocks and bonds…