Published by Bob Elliott on Jun 5, 2023 4:04:46 PM

Hedge Funds are roughly flat in ‘23 while a broad market cap weighted index of US stocks has risen 9% since the start of the year through the end of May. The divergence has led some very short-term focused investors to conclude that Hedge Funds generate little alpha relative to traditional passive index investing. Short-term and long-term evidence pretty clearly debunks that conclusion.

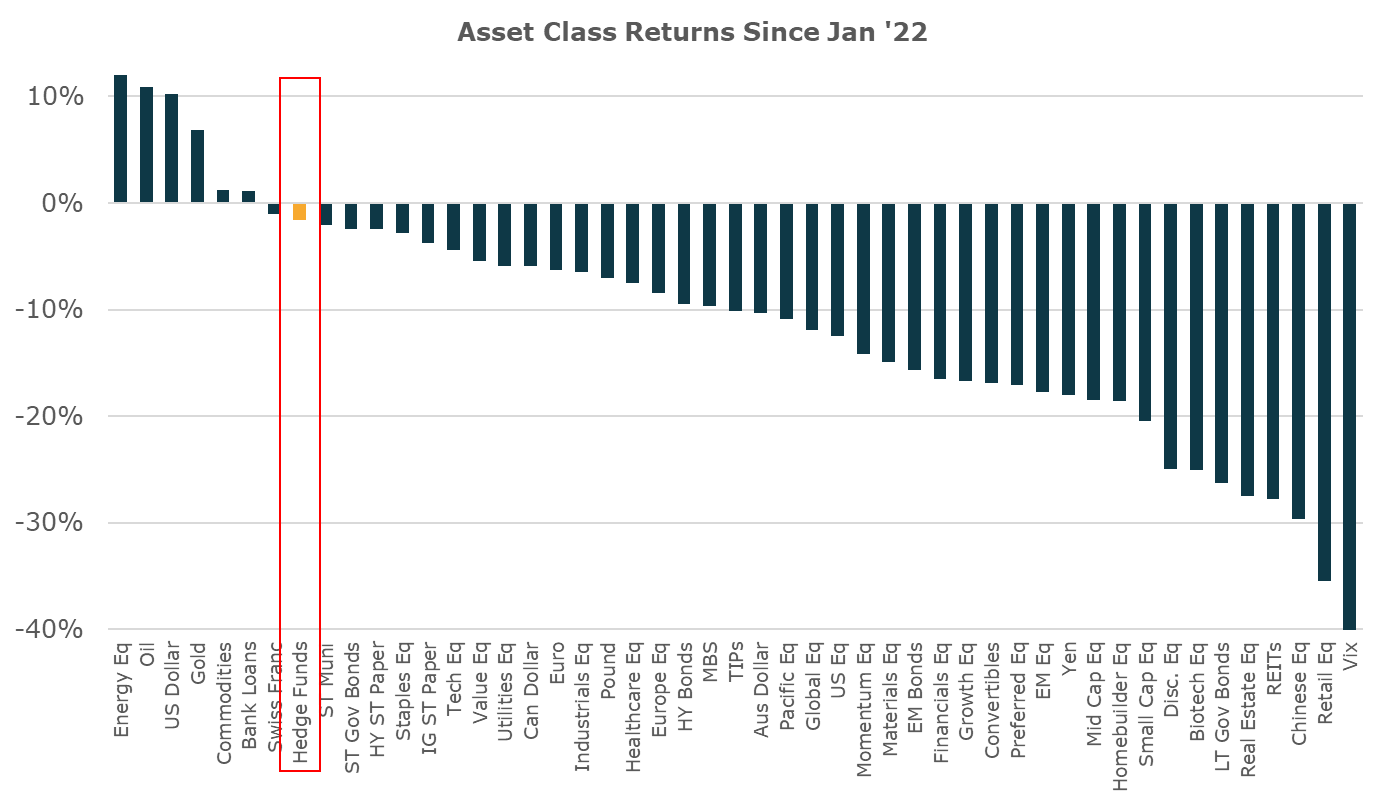

Rather than focus on just a few months, even a modestly longer view highlights the relative strength of hedge fund performance. The transition from secularly easy monetary policy to the fastest tightening cycle in decades created significant pressure across most asset classes. While assets have rebounded in early ‘23, simply expanding the horizon out to the start of ‘22 when tightening began shows how diversified alpha has done pretty well relative to most assets, outperforming nearly every asset class except for commodities and outright bets on the dollar.

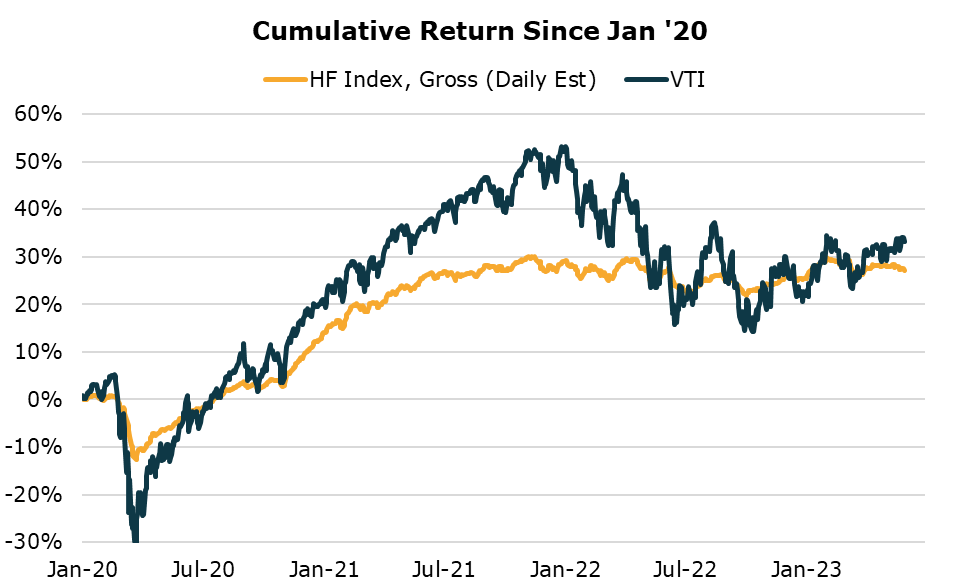

If we look at a broader recent lens – say since the start of 2020 when COVID hit – we also see that Hedge Funds are doing just as we’d expect, delivering returns on par with stocks but with much less significant volatility. Through the period, the returns of hedge fund strategies have been on par with stocks, but experienced roughly 1/5 the volatility!

This is a good sampling because it shows a wide range of different market environments captured in a mere 3.5 year timeframe. Economic crisis, stimulation, inflationary rises, and tightening are all included within this period, which makes it a good stress test of any strategy.

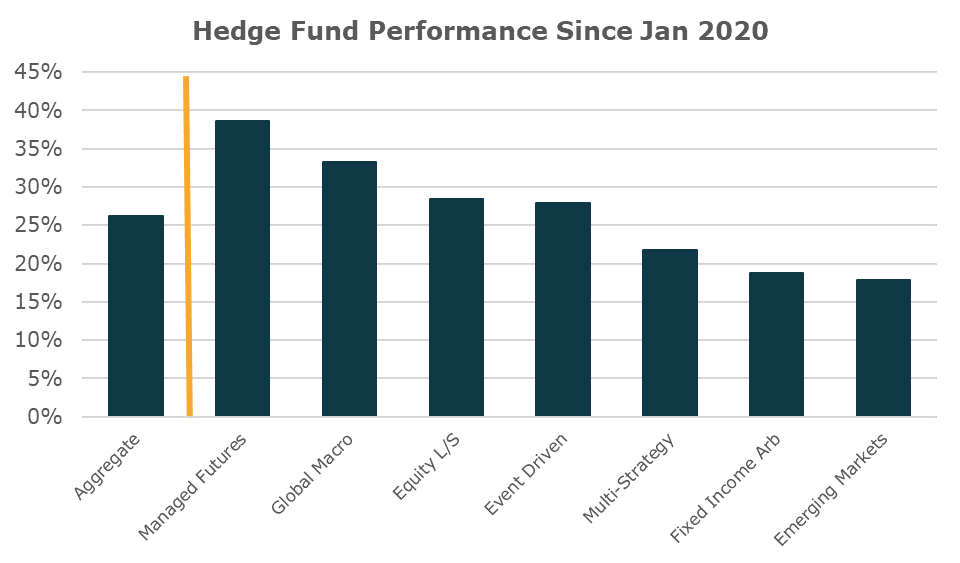

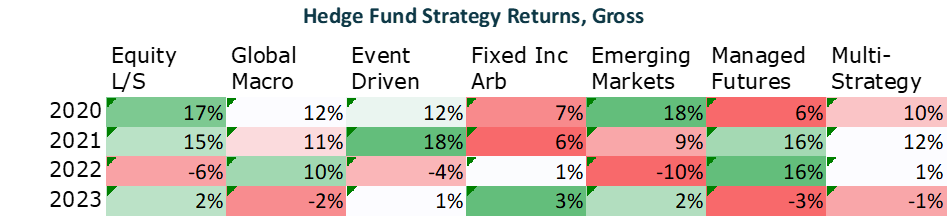

Strategy diversification was critical to creating a lower volatility return stream over the period. Overall during the period since COVID, all the strategies delivered positive returns with no one strategy showing particularly outsized outcomes.

While all the underlying strategies did pretty well over the period, there were significant benefits of diversification as some strategies did considerably better than average in some years and considerably worse in others. That’s the beauty of holding them all together that the index brings. The return consistency comes from the strategy diversification.

Over longer periods of time, the same basic picture emerges. Hedge fund strategies deliver returns on par with the equity markets, but with considerably lower volatility. The returns over the last 20+ years highlight that the outcomes since the start of COVID are pretty normal across cycles. While stocks did outperform during periods of very easy money, it is unlikely that such periods will return again any time soon.

While Hedge Funds have trailed equity indexes this year, it doesn’t make much sense to conclude that hedge fund strategies offer no alpha over time as a result. Even a cursory expansion of the recent performance period examined – whether to 2022 or to 2020 – shows how hedge fund strategies have delivered differentiated returns relative to most other asset classes including passive equity investing. Longer-term perspective also makes clear that Hedge Funds have delivered returns on par with stocks with lower risk over decades. These perspectives put together suggest that it’s not quite time to write off Hedge Funds yet.