Published by Bob Elliott on Jun 20, 2023 8:44:55 AM

Going into March, Hedge Funds had been increasingly positioned for continued economic momentum and higher interest rates. The Silicon Valley Bank failure and subsequent deflationary credit crunch market dynamics created significant pain for many hedge funds. Following that period of rough performance, Hedge Funds first positioned for a balanced range of outcomes in April/May and now are dipping their toe back in the water positioning for higher for longer. The positioning of these sophisticated investors suggests a low probability of an immediate recession and that there will be more tightening than priced in ahead.

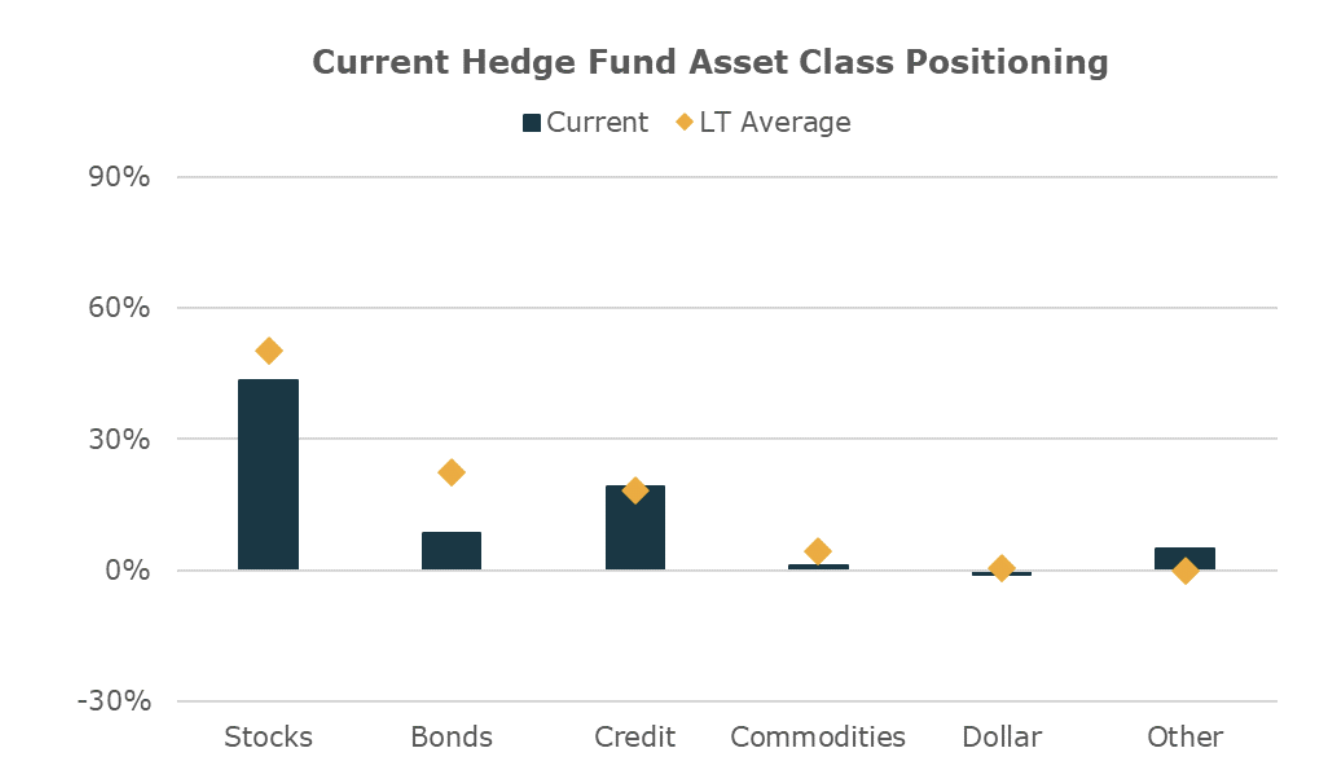

The chart below gives perspective on Hedge Funds current positioning by major asset class. What is most notable is the significantly reduced duration positioning across funds relative to normal. While not as extreme as last year, this suggests these funds are expecting higher rates for longer ahead.

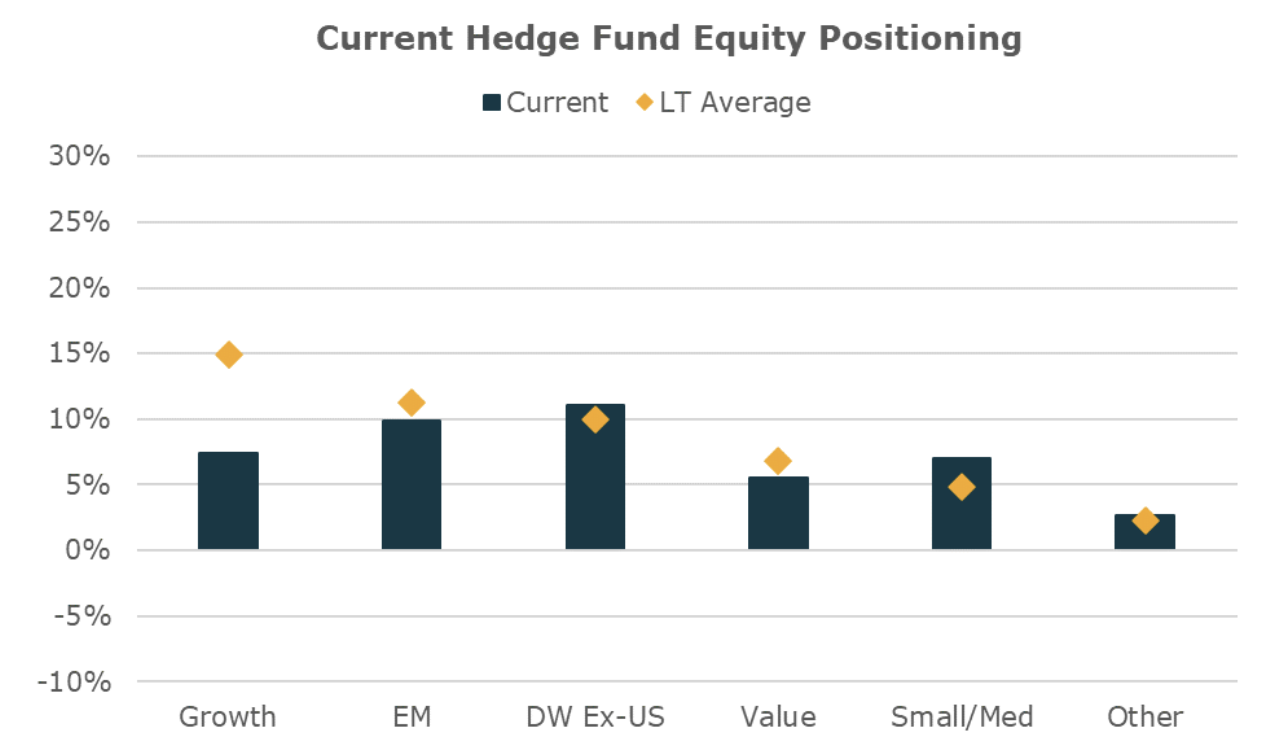

Stock positioning is also consistent with the expectation of higher rates as well. Hedge Funds hold substantial underweights to growth stocks, which have been sensitive to rising rates in the past. Also notable that funds are overweight non-US DW stocks such as Japan, a country that is a few steps behind in the tightening cycle relative to the US.

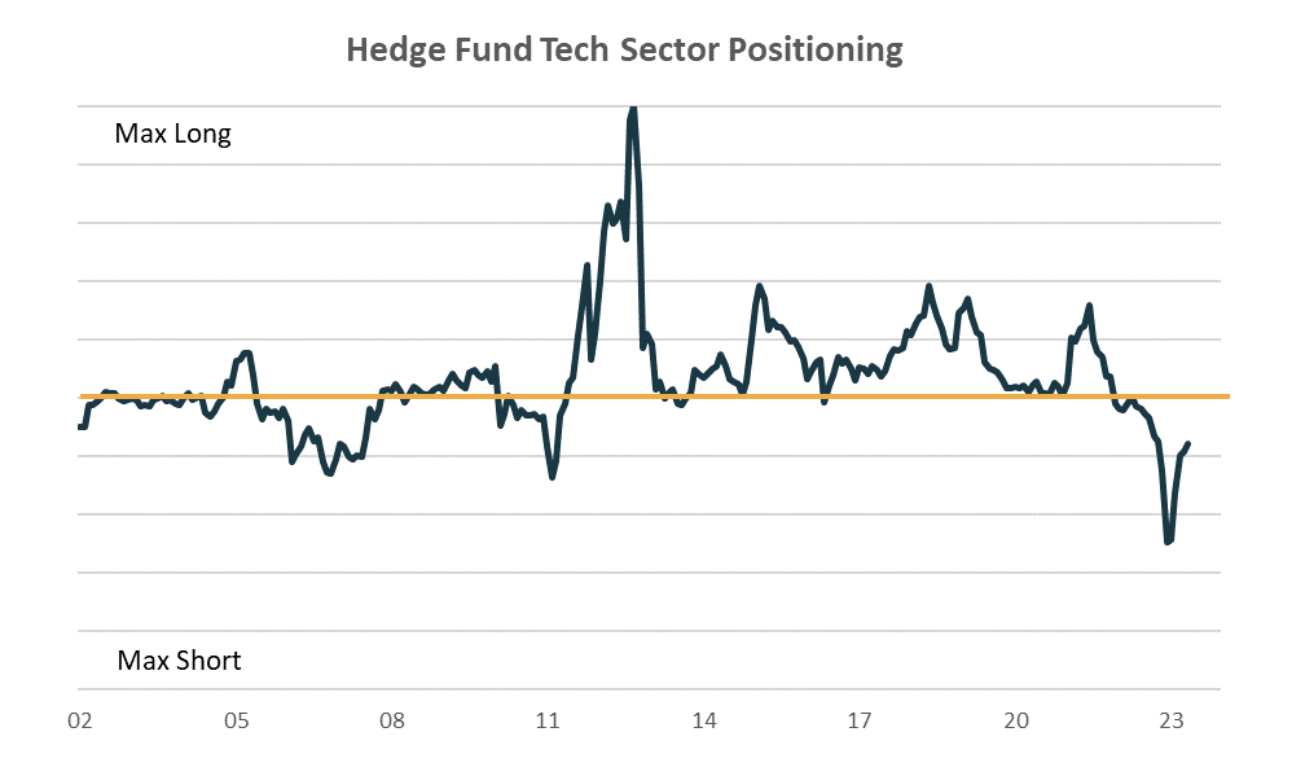

One of toughest positions for the Hedge Fund industry this year has been underweight tech stocks. The combination of elevated valuations with high rising rate sensitivity aligned with the substantial shorts coming into the year. While funds have scaled back their views, they still remain short relative to normal.

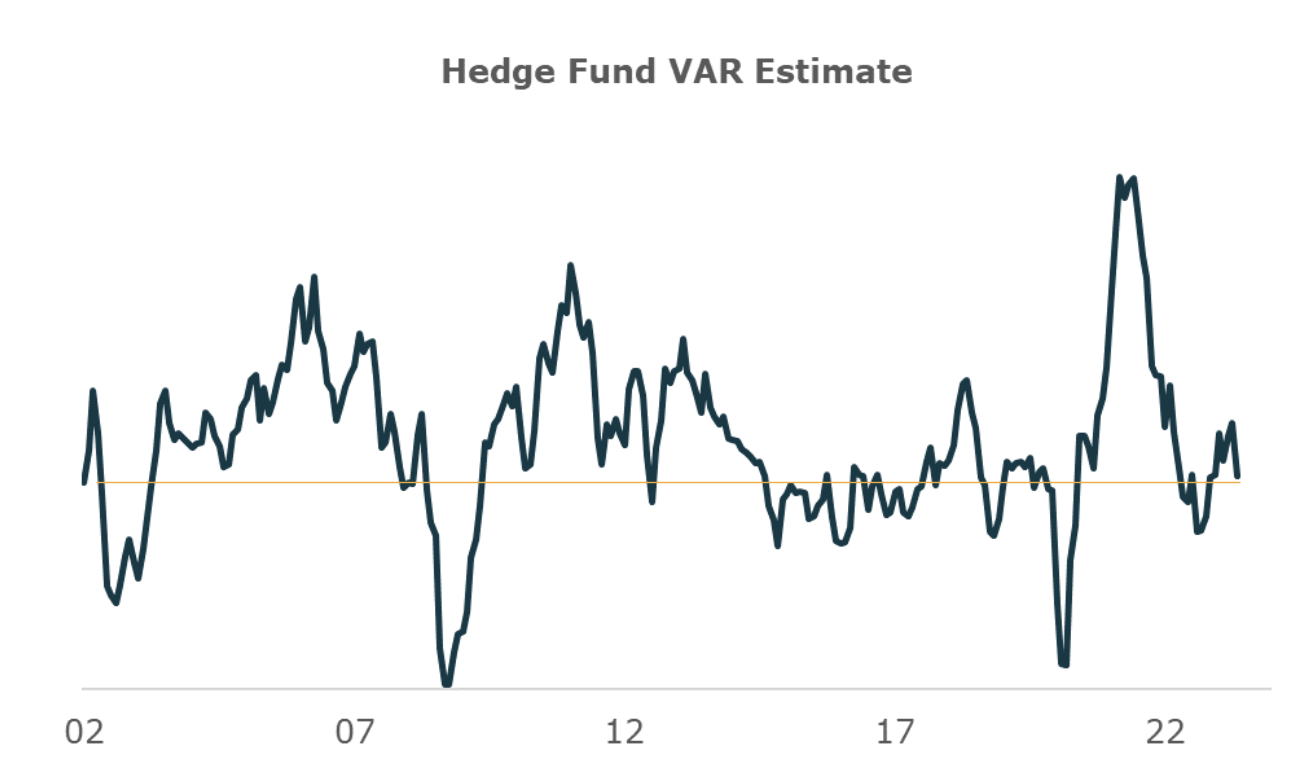

While all this aligns with higher for longer positioning, it’s important to recognize that funds are still running relatively low risk in their portfolios during a time when estimated risk (say from VIX) is extremely low. This suggests that most funds continue to find the macro environment pretty uncertain particularly following the higher for longer reversal following the SVB failure. And in that environment a cautious approach is being pursued. While that may not be generating the same returns as the top few stocks in the S&P, Hedge Funds are doing just what they have done for decades – preserving capital well during challenging times.