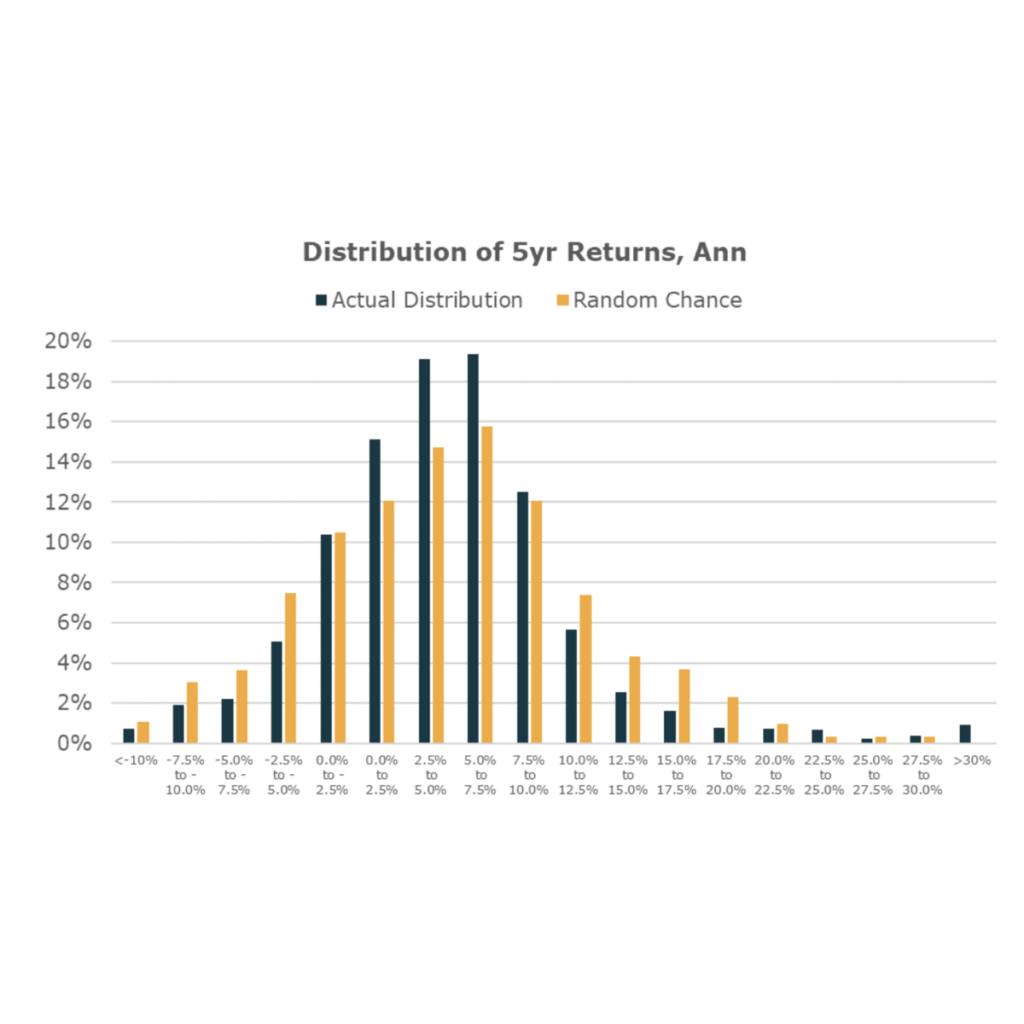

The Best Skill or the Most Luck?

One of the hardest things to do in investment management is figure out if outcomes are a function of luck or skill…

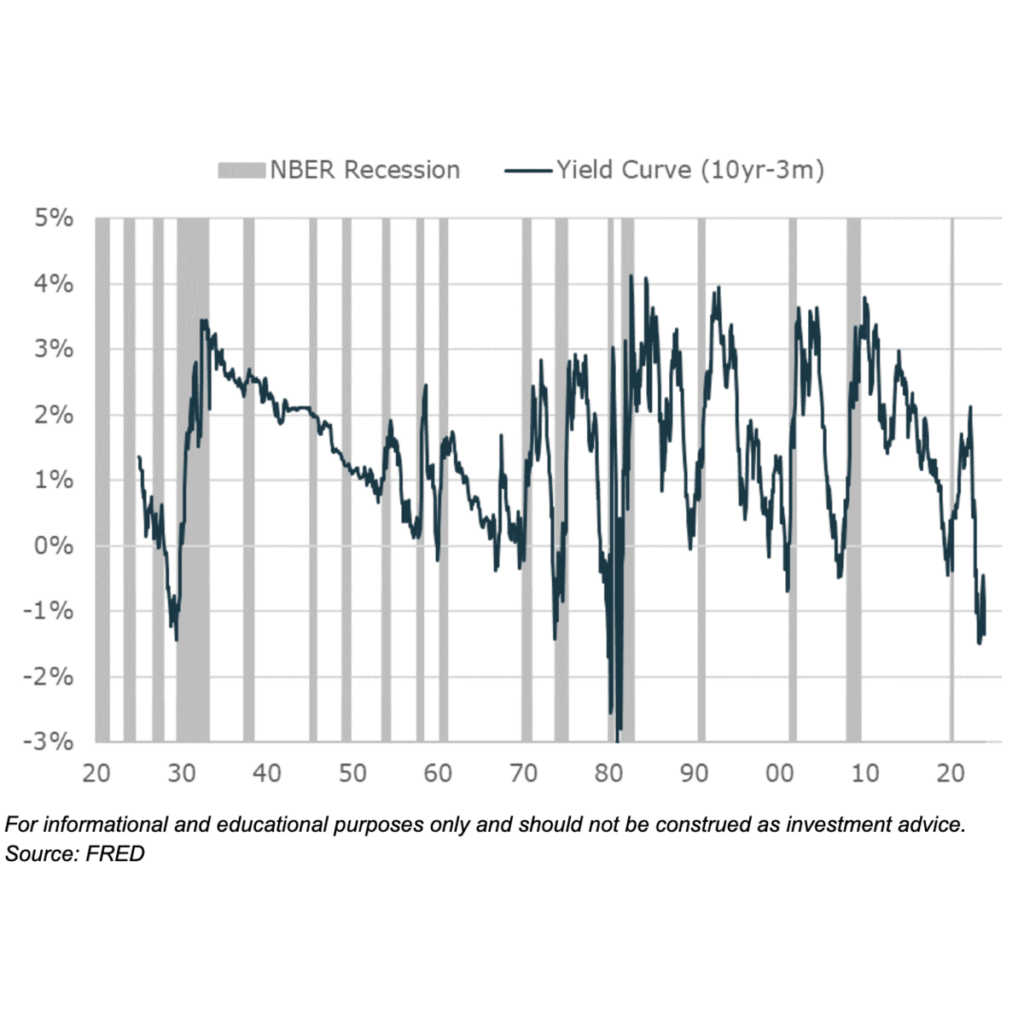

Far From Perfect: Inverted Yield Curves Don’t Reliably Predict Recessions or the Direction of the Markets

On October 25, 2022 the yield curve flipped to inverted and has remained so for the nearly 500 days since…

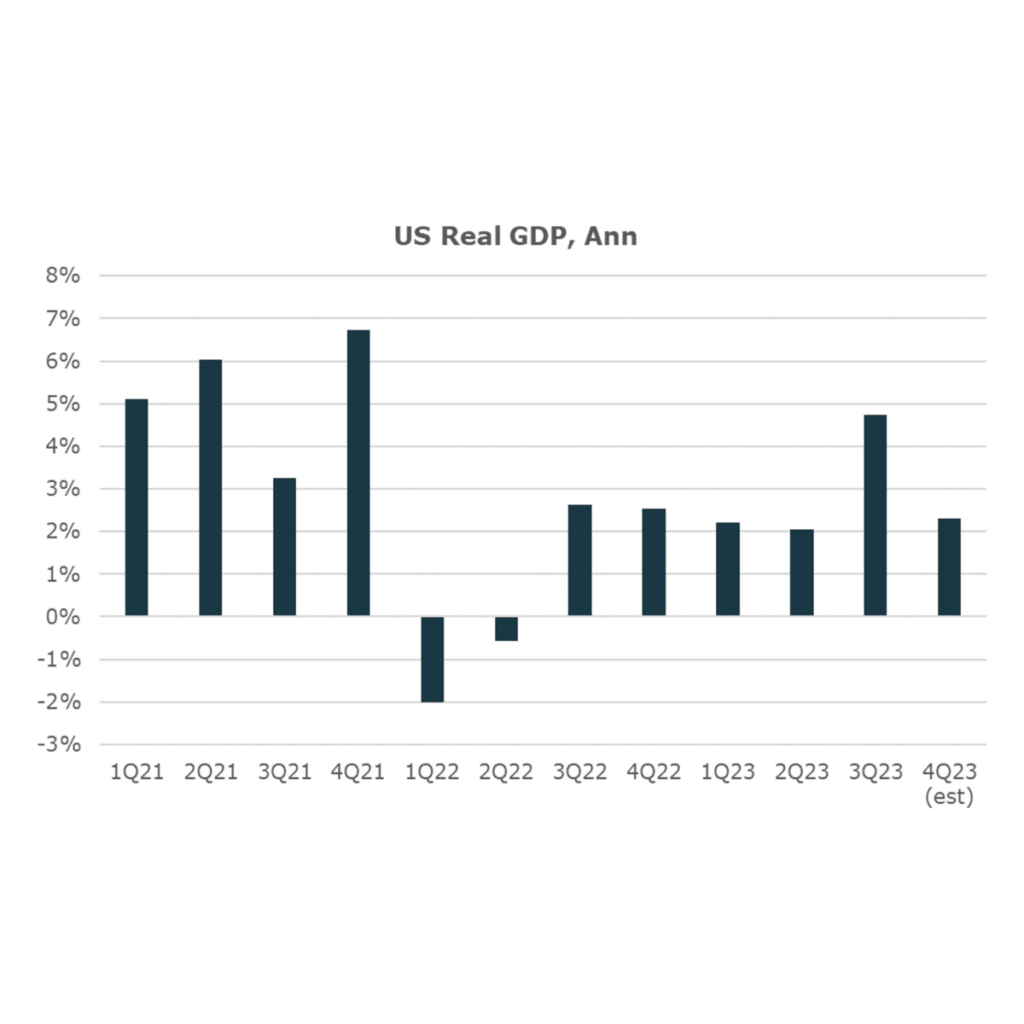

The Outlook 2024: Stronger for Longer

Despite prognostications and market pricing of a near certain recession at the start of 2023, the US economy not only avoided a downturn, it thrived…

Not All-in on US Mega Cap Stocks? That’s Prudent, But Currently Underperforming

US stocks outperformance of pretty much everything returned again in 2023…

Is The U.S. Economy in a Recession?

Published by Bruce McNevin on Nov 27, 2023 With conflicting macroeconomic indicators and diverging expert opinions, we reviewed the National Bureau of Economic Research (NBER) recession indicators to determine if the economy is in a recession. They suggest that the answer is no, not yet. Figure 1 contains our ‘recession barometer’ which compares the most recent monthly […]

Where To Turn When Stocks and Bonds Move Together

Historically, 60/40 investors have relied on bonds to protect their equity positions and preserve capital through market down-turns…

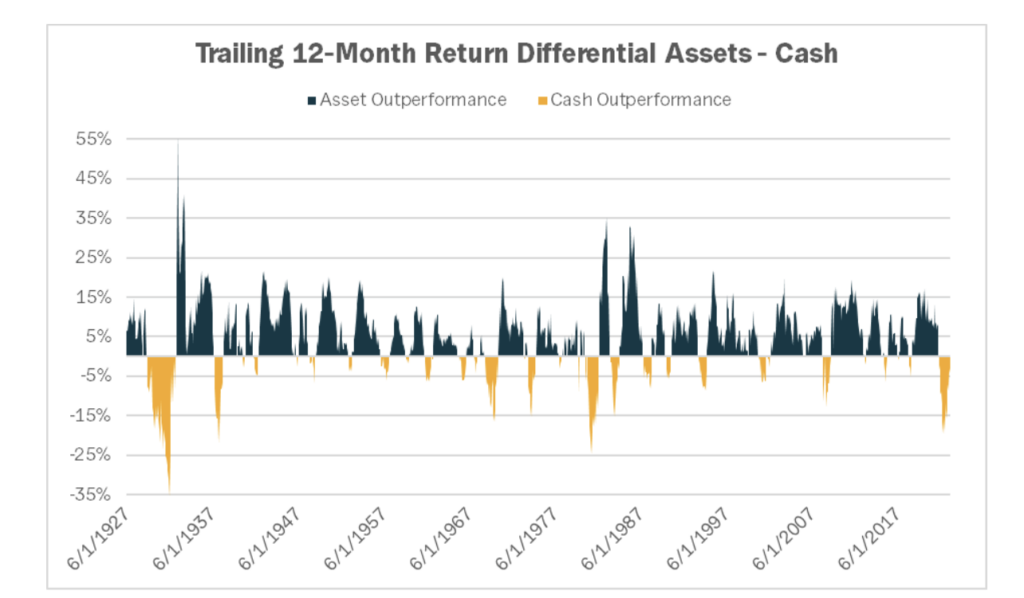

Don’t Overweight Cash Unless You’re a Market-Timing Genius

Effectively timing the market requires extreme skill. Fortunately, diversification allows…

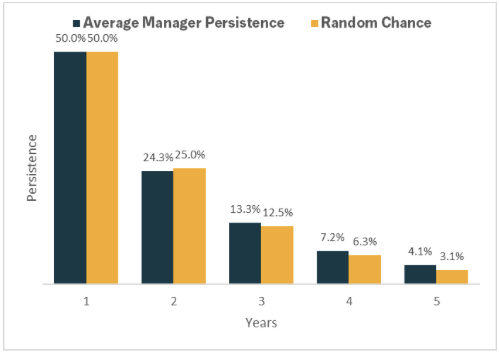

Who Is Better: Hedge Fund Allocators or Dart-Throwing Monkeys?

Every hedge fund allocator dreams of finding the portfolio of managers that reliably outperforms…

What’s Under the Hood? What Matters for ETF Liquidity

Understanding the liquidity of an individual stock, bond, or futures contract is…

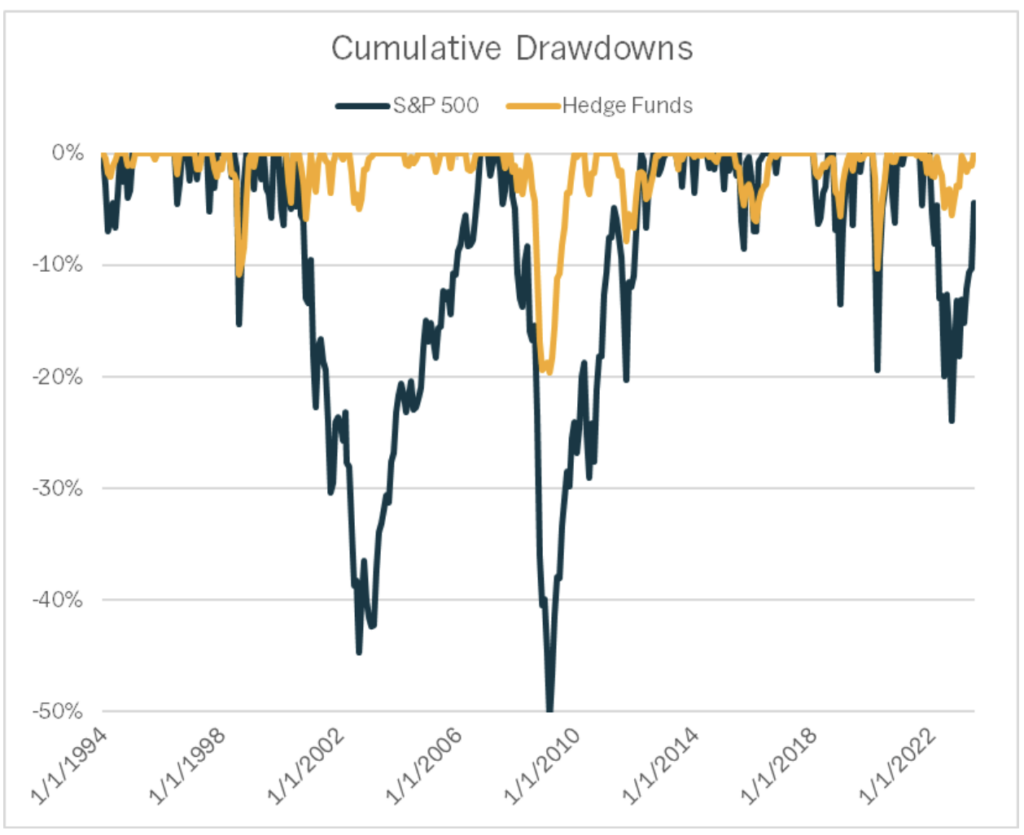

Harnessing the Wisdom of the Crowd to Mitigate Down-side Risk

Over the past thirty years, hedge funds have proven an uncanny ability to avoid significant down-side risk in equities.