4Q 2025 Unlimited Hedge Fund Barometer

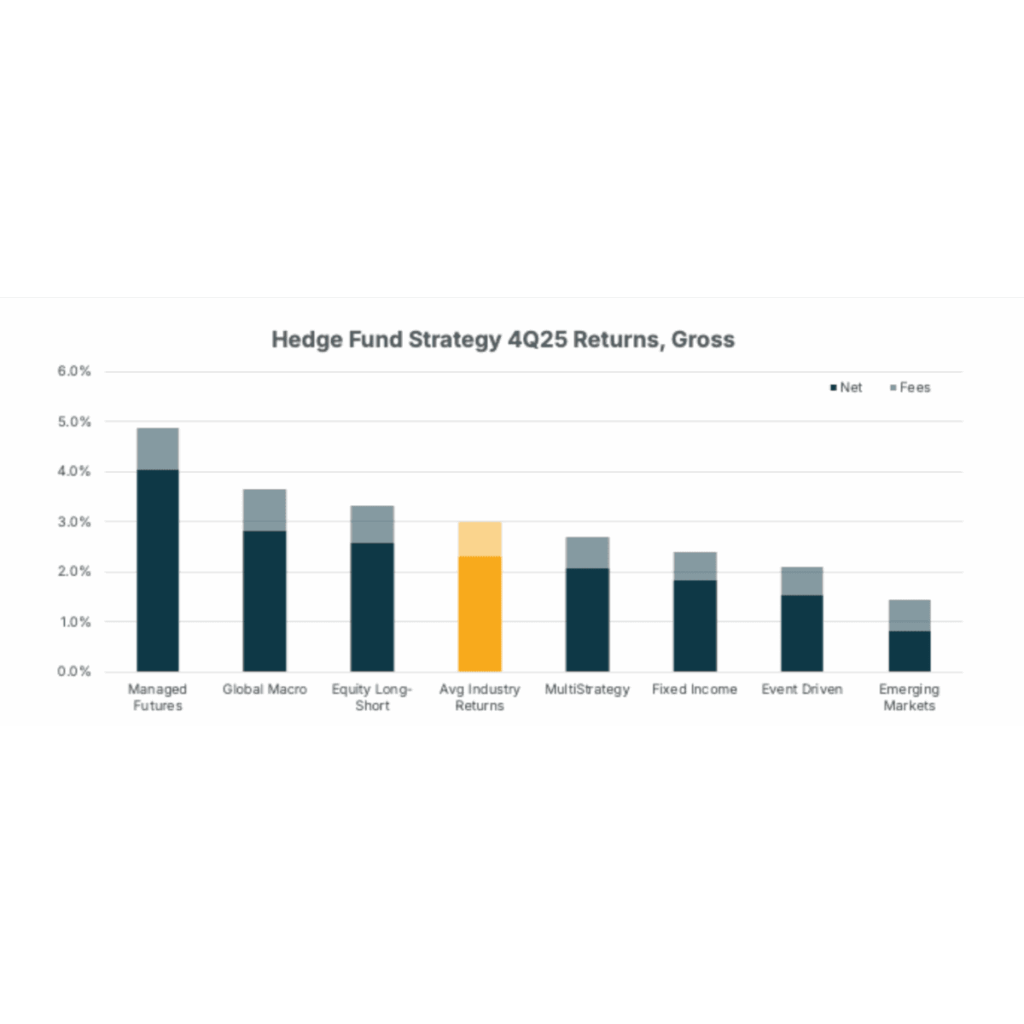

Hedge Funds delivered strong positive performance in Q4-25 with Managed Futures and Global Macro strategies benefitting from rallies in gold and ex-US equities while Emerging Markets strategies were modestly positive, challenged by geopolitical uncertainty.

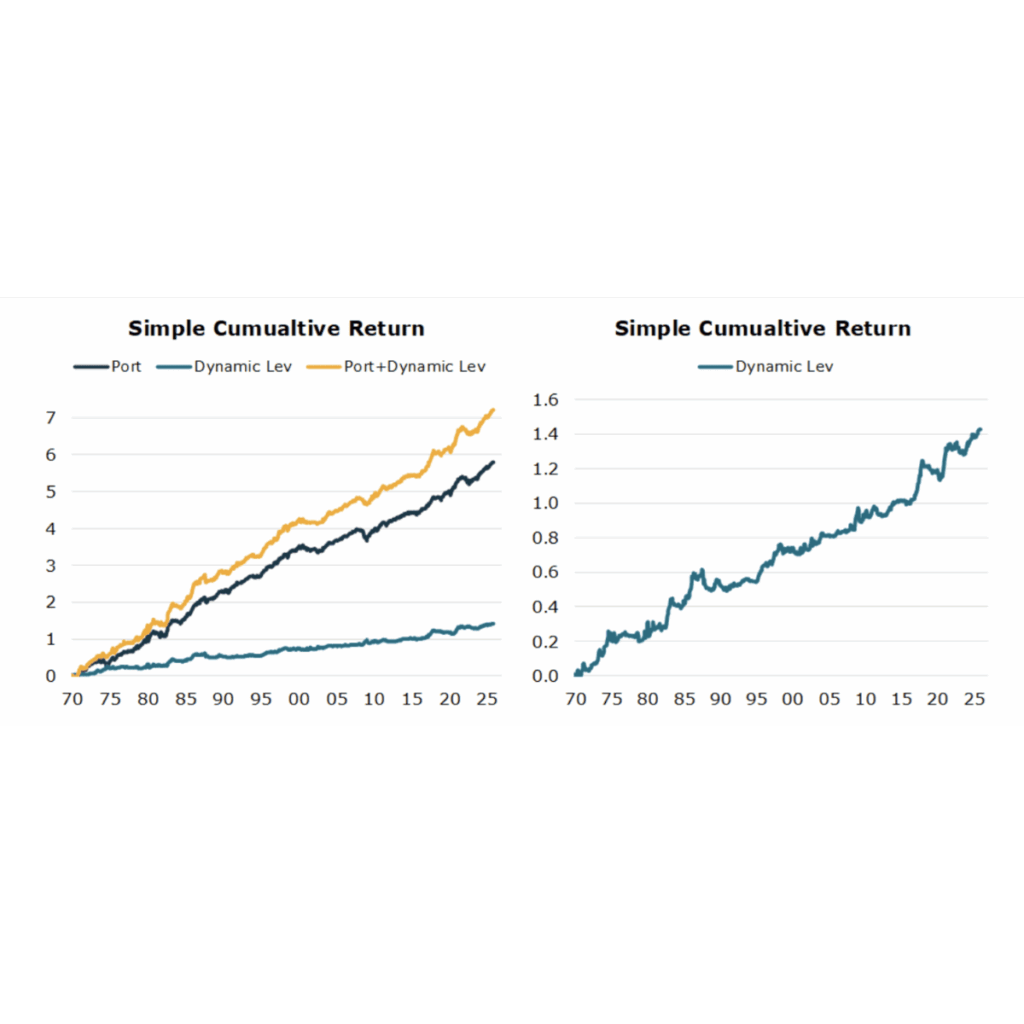

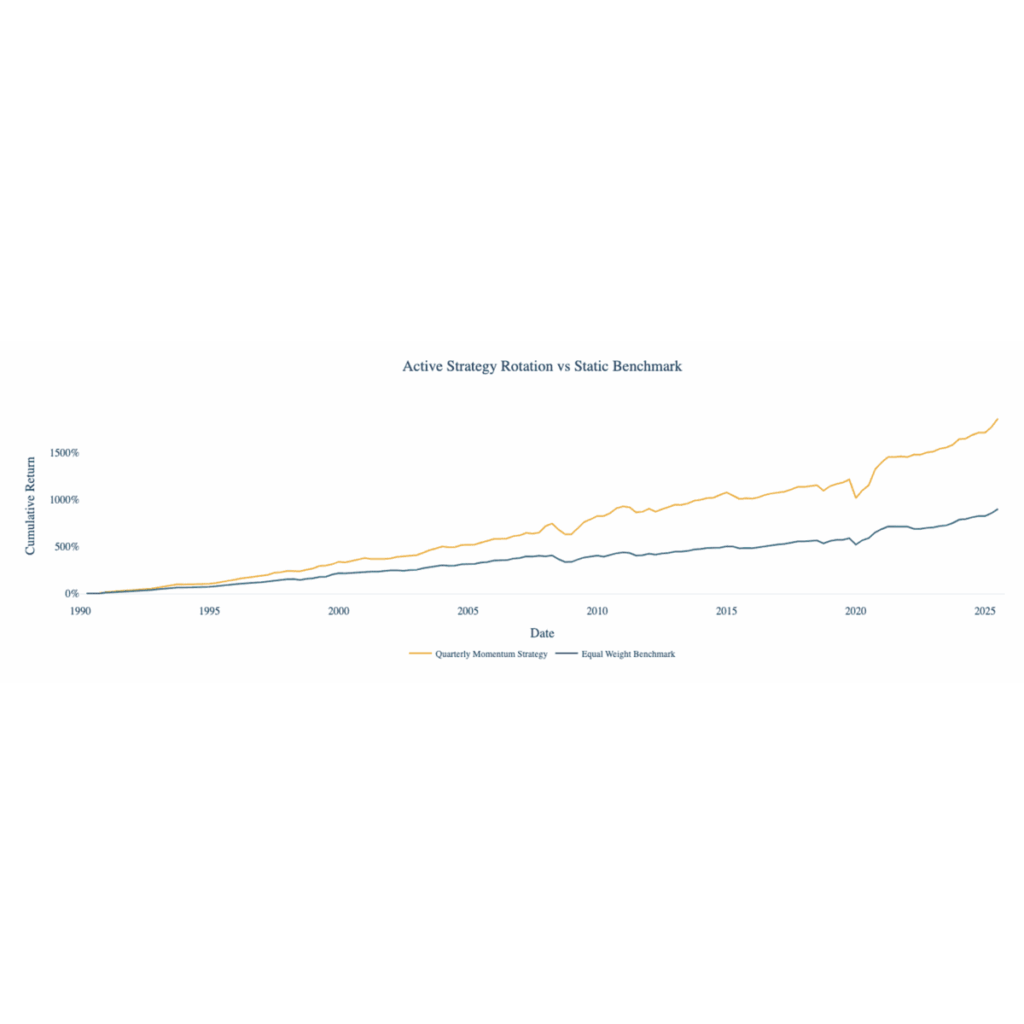

Considering the Benefits of Dynamic Leverage

Folks who have been in the asset management business long enough have witnessed that most financial assets experience long cycles of favor (booms to bubbles) and disfavor (“lost decades”).

A Fork in the Road

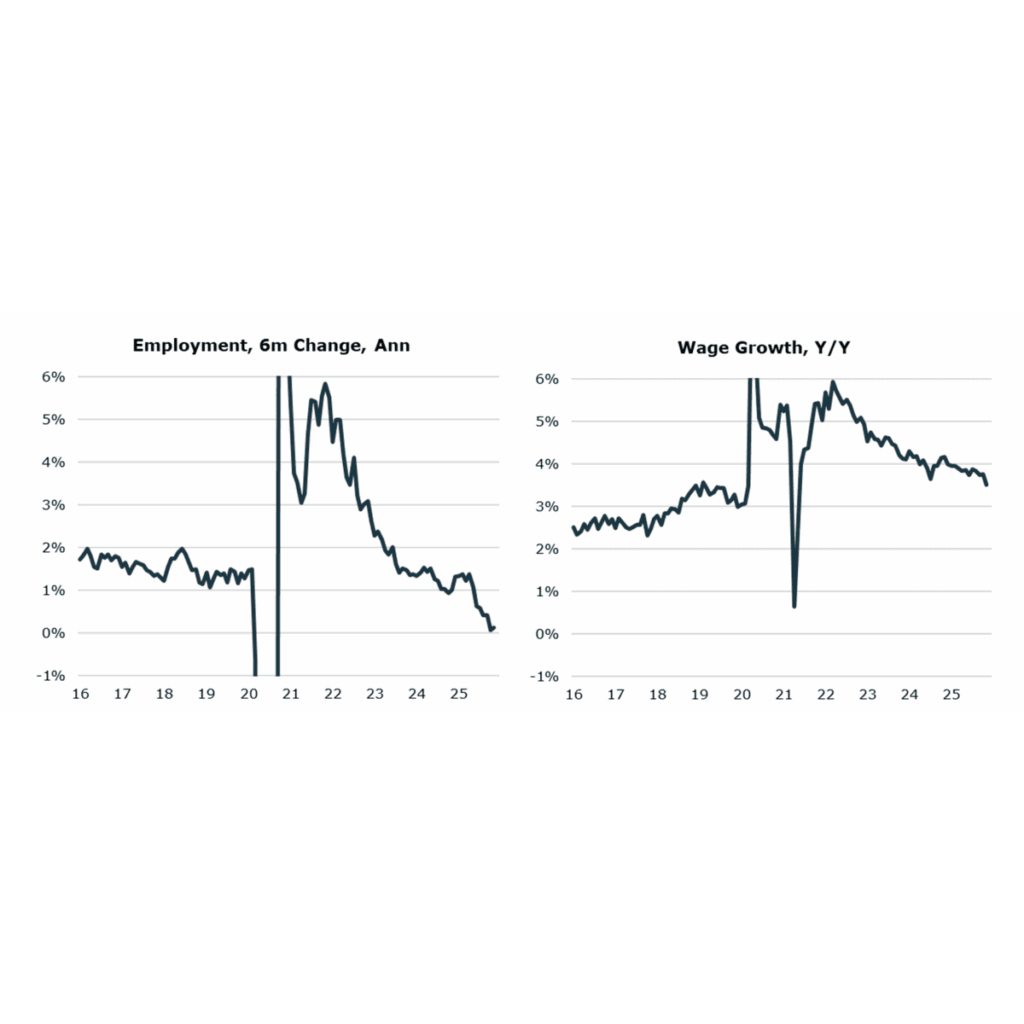

The US economy enters 2026 in a more fragile state than in many years. Strict immigration restrictions, weak hiring demand, and tariff hikes have eroded both household income growth and real spending power.

‘Tis the Season….to Tax Loss Harvest?

By Bob Elliott and Nathan Nangia Dec 1, 2025 December doesn’t just mark the season of last-minute shopping, gingerbread houses, holiday feasts, and inevitably, stretchy pants — it also marks the beginning of another meaningful season: tax-loss harvesting. For many investors, 2025 has been a constructive year, with a traditional 60/40 mix of stocks and […]

Hedge Fund Style Outperformance Persistence & Its Consequences

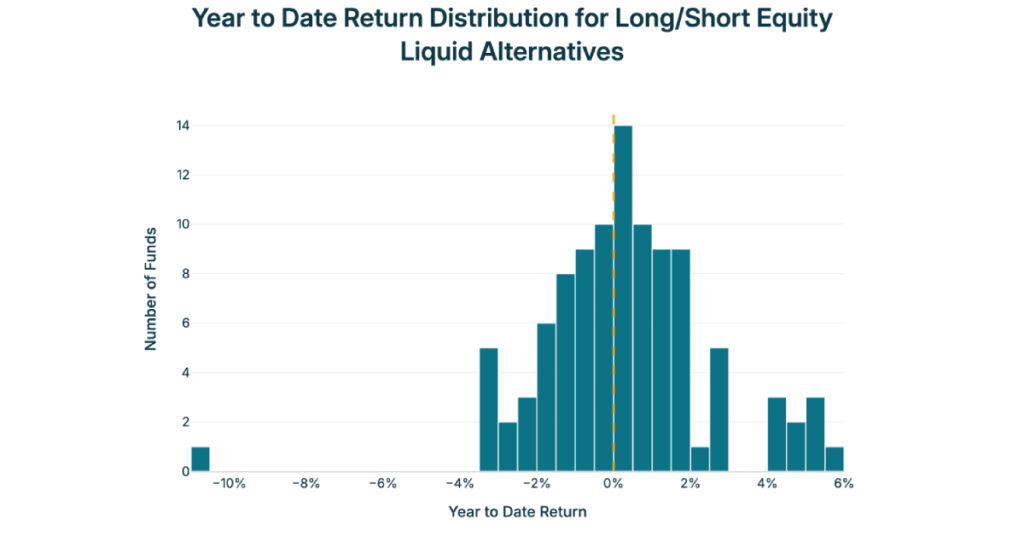

Global Macro and Equity Long/Short hedge fund styles have excelled year to date. Can it continue?

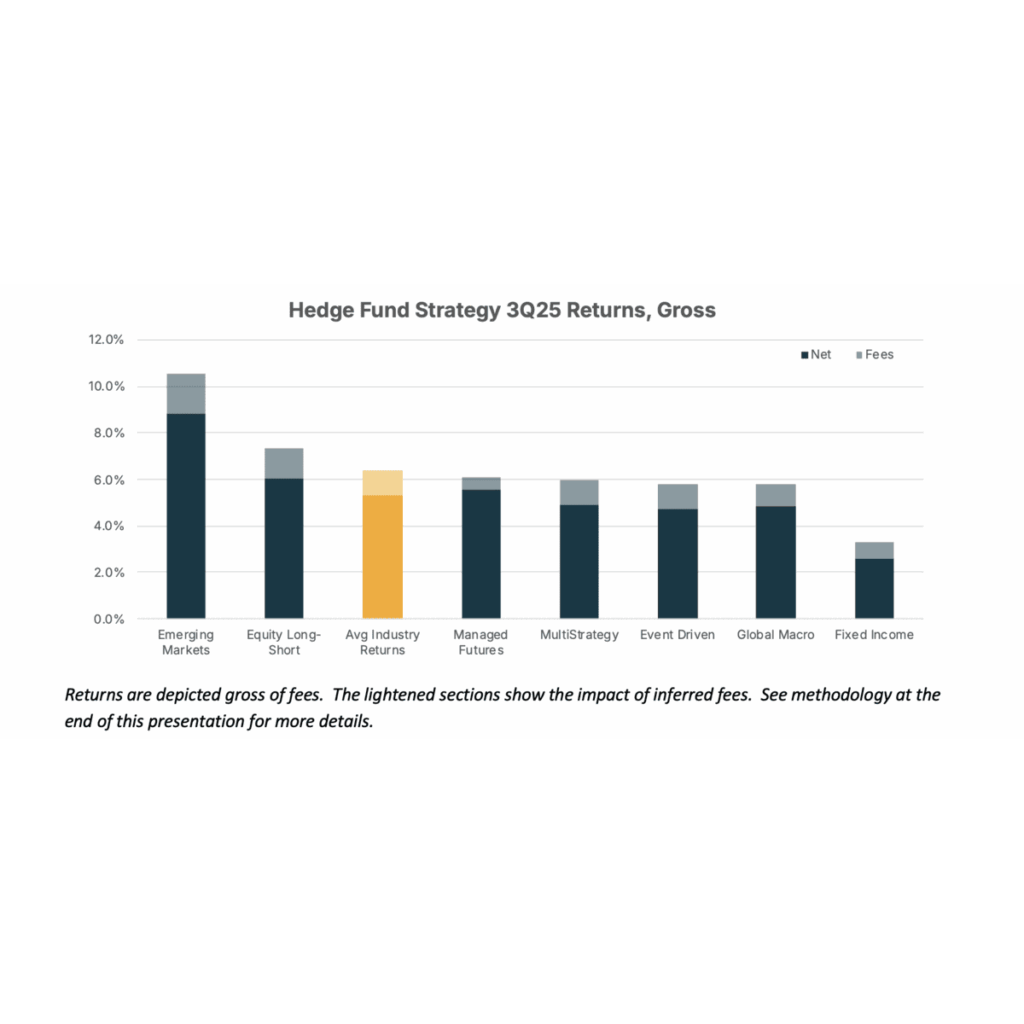

3Q 2025 Unlimited Hedge Fund Barometer

Hedge Funds delivered strong positive performance in Q3-25 with Emerging Market and Equity Long/Short strategies benefitting from rallies in Asian equities while Fixed Income strategies were modestly positive, challenged by tighter credit spreads.

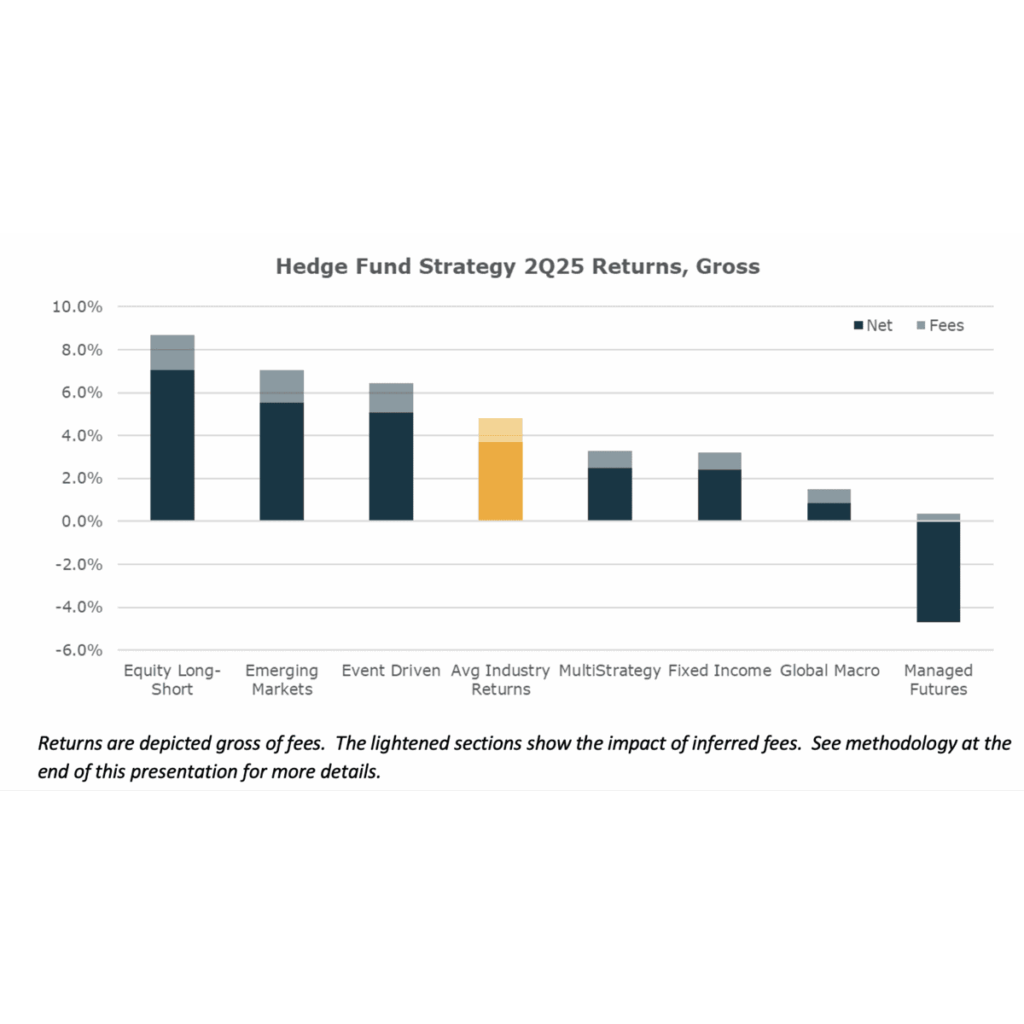

2Q 2025 Unlimited Hedge Fund Barometer

2Q 25 Hedge Fund Strategy Performance, Gross of Fees Summary Commentary Hedge Funds delivered moderately positive performance in 2Q25 with Equity Long/Short and Emerging Market strategies benefiting from strong global asset performance while Managed Futures strategies were negative, challenged by choppy market conditions. Hedge Funds maintained relatively conservative positioning through the quarter given the significant […]

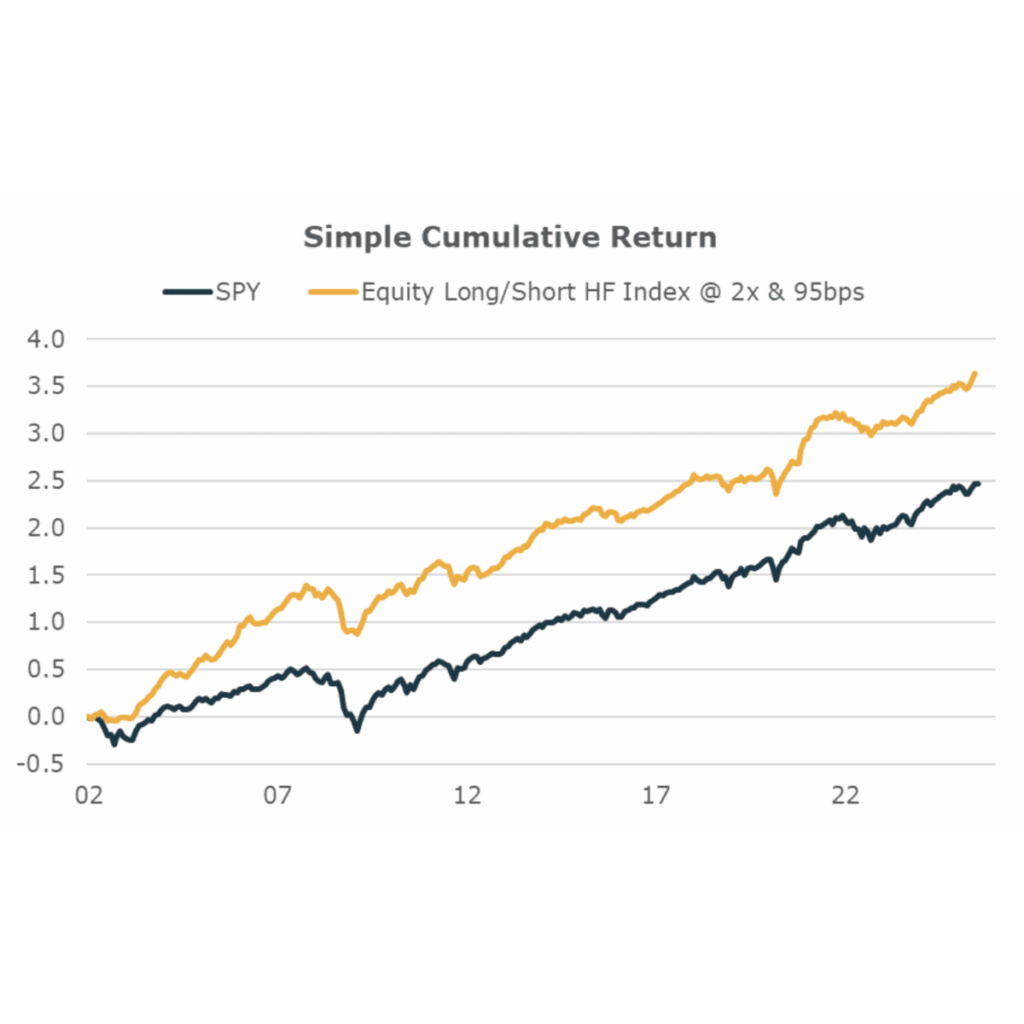

Considering The Benefits of Equity Long/Short Hedge Fund Alpha

Published by Bob Elliott July 21, 2025 With nearly $10tln invested in actively managed equity mutual funds and ETFs and another $1.5tln in Equity Long/Short hedge funds it seems nearly most investors, advisors, and allocators are searching for an equity manager that can consistently outperform. As many folks have learned through time, the vast majority […]

Considering The Benefits of Managed Futures Alpha

Allocators often face challenges designing portfolios that can help limit losses in down market environments. Despite the need, there are few investment offerings that perform well when other assets underperform but don’t also suffer from burdensome drag on the portfolio over time.

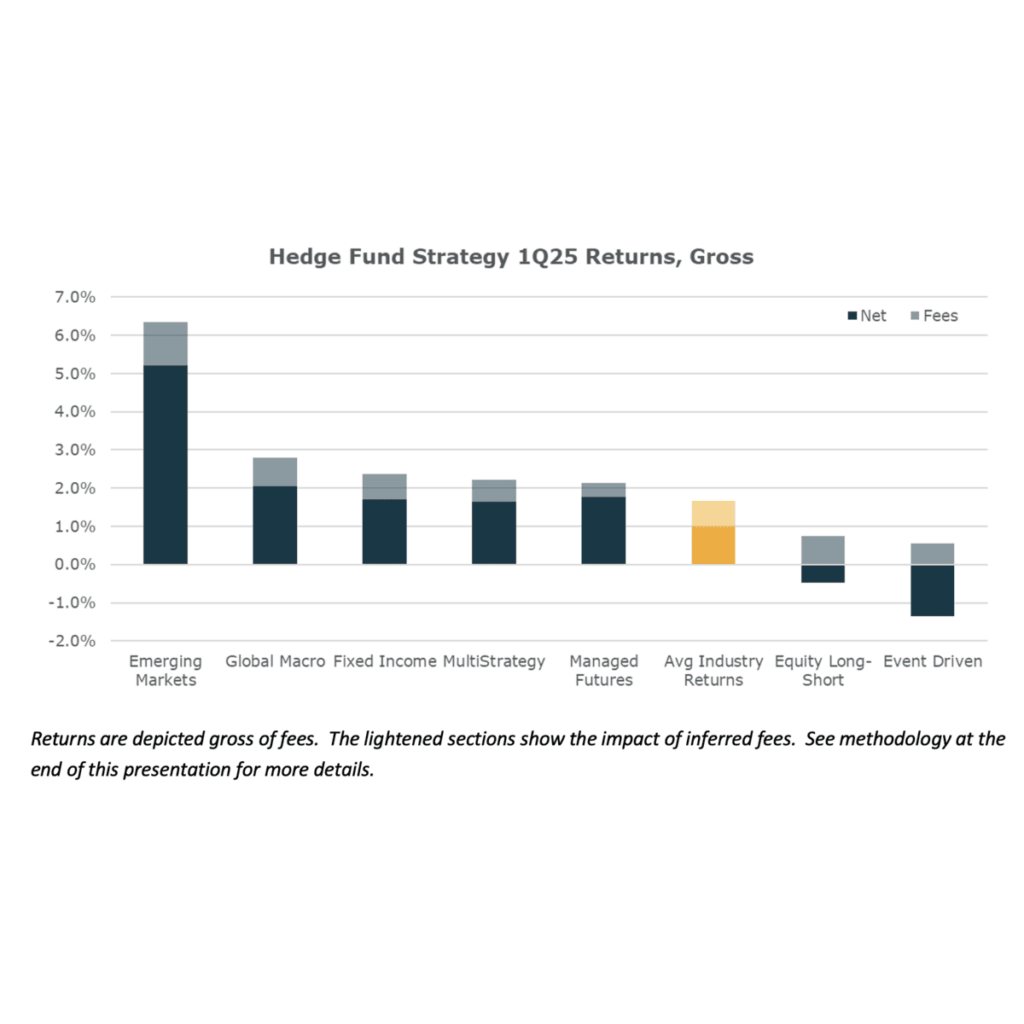

1Q 2025 Unlimited Funds Hedge Fund Barometer

Hedge Funds eked out modestly positive performance in 1Q25 with the mix of sub-strategy returns largely reversing the moves of the previous quarter. Emerging Market funds outperformed meaningfully as Chinese stocks surged, meanwhile Equity Long/Short and Event Driven delivered weak outcomes.