Unlimited Blog

At Unlimited® we are experienced investors using machine learning to create products that replicate the index returns of alternative investments.

4Q 2025 Unlimited Hedge Fund Barometer

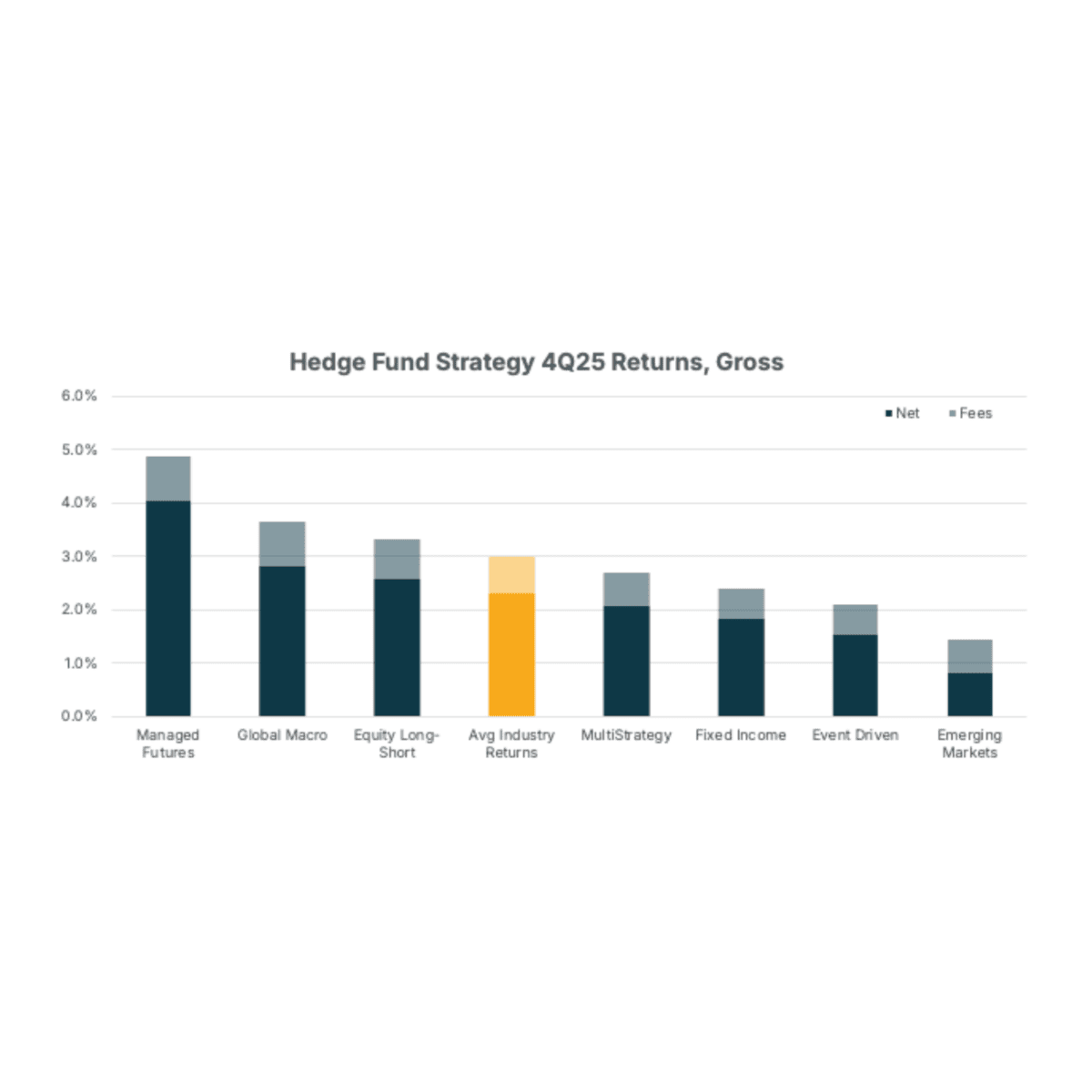

Hedge Funds delivered strong positive performance in Q4-25 with Managed Futures and Global Macro strategies benefitting from rallies in gold and ex-US equities while Emerging Markets strategies were modestly positive, challenged by geopolitical uncertainty.

Top Posts

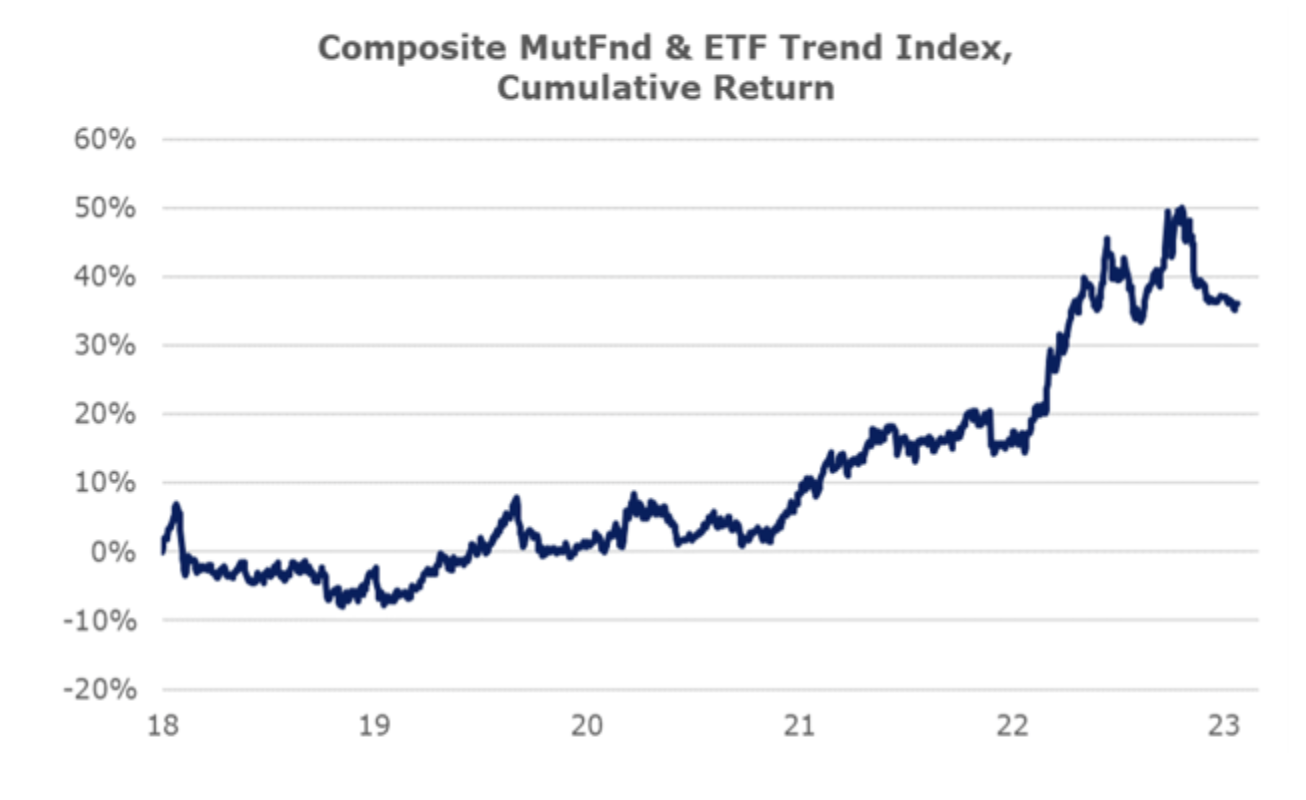

The Trend Following Disappointment

Interest in trend-following strategies had a resurgence last summer as both bonds and stocks fell…

A Prime Opportunity To Improve Diversification

2022 was a difficult year for most investors and advisors. The one silver lining is that this…

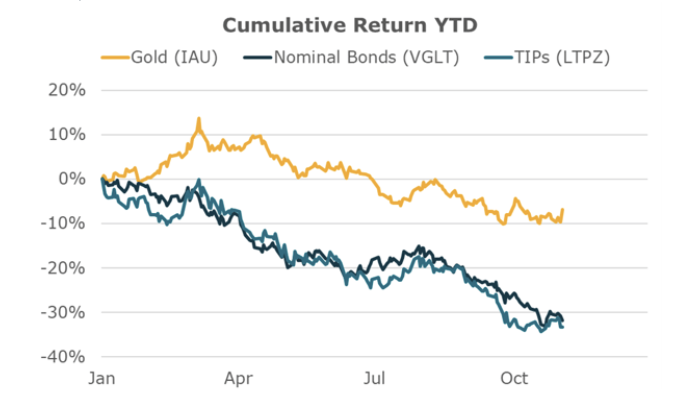

The Role of Gold In a Portfolio

Gold is a unique financial asset. It is best thought of as a non-interest bearing real asset…

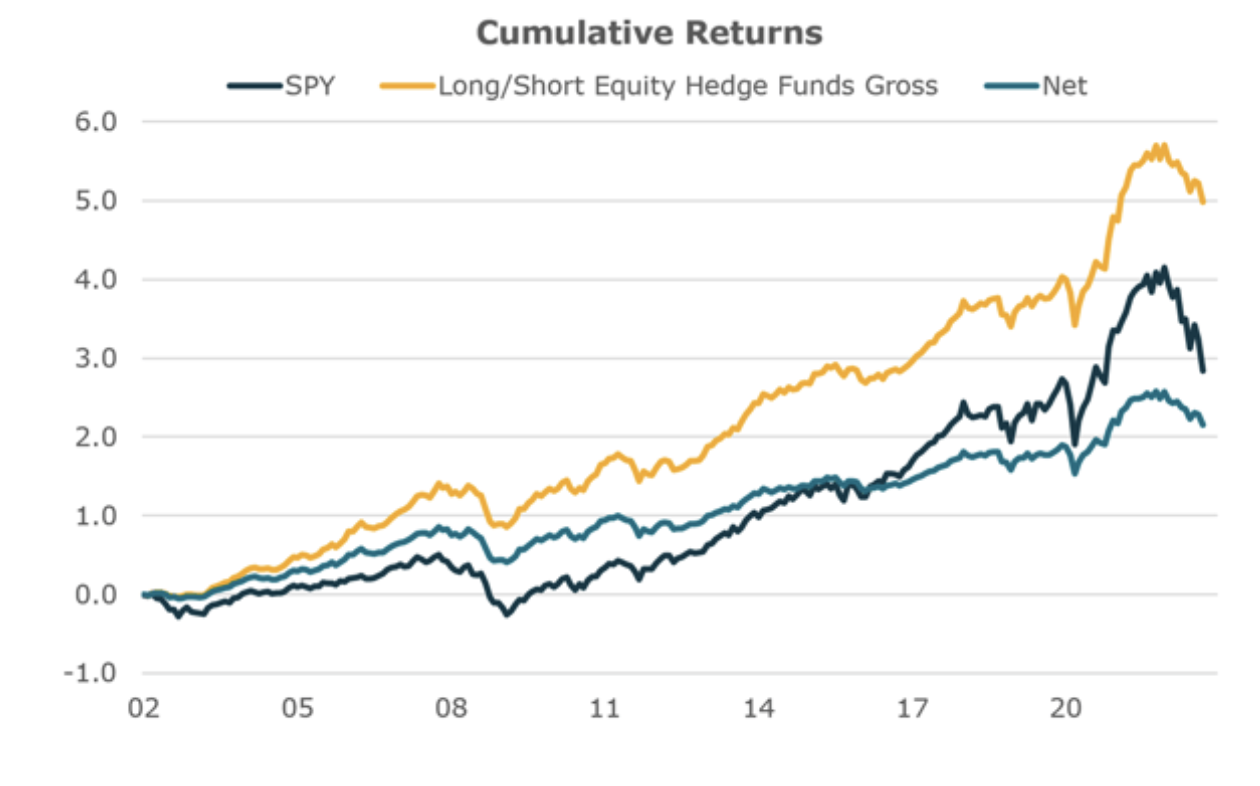

L/S Equity Has A Fee Problem, Not a Performance Problem

Long Short Equity hedge funds have taken a lot of heat in the press recently. After years of…

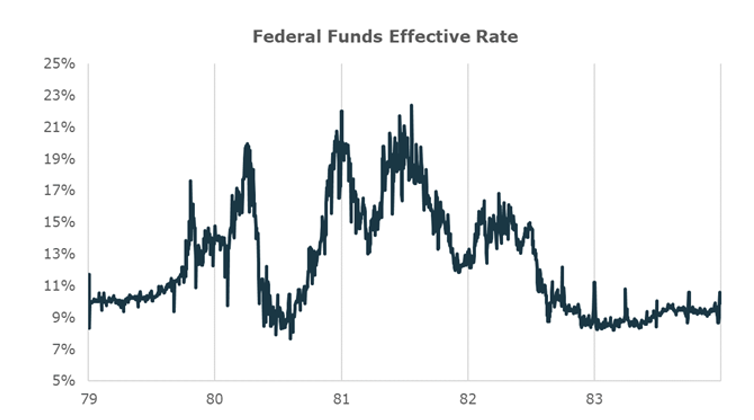

Lessons From Volcker’s Inflation Fight

All eyes are on Chairman Powell’s speech this week for his thoughts on how he will tackle today’s…

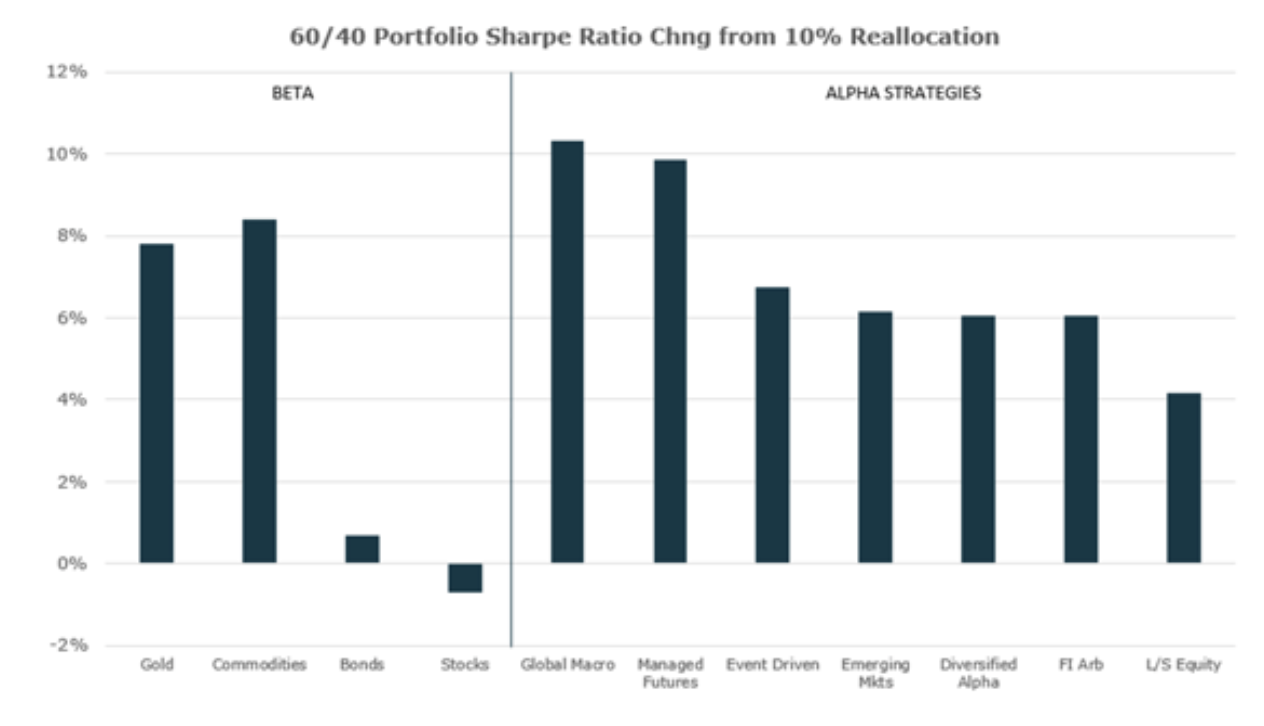

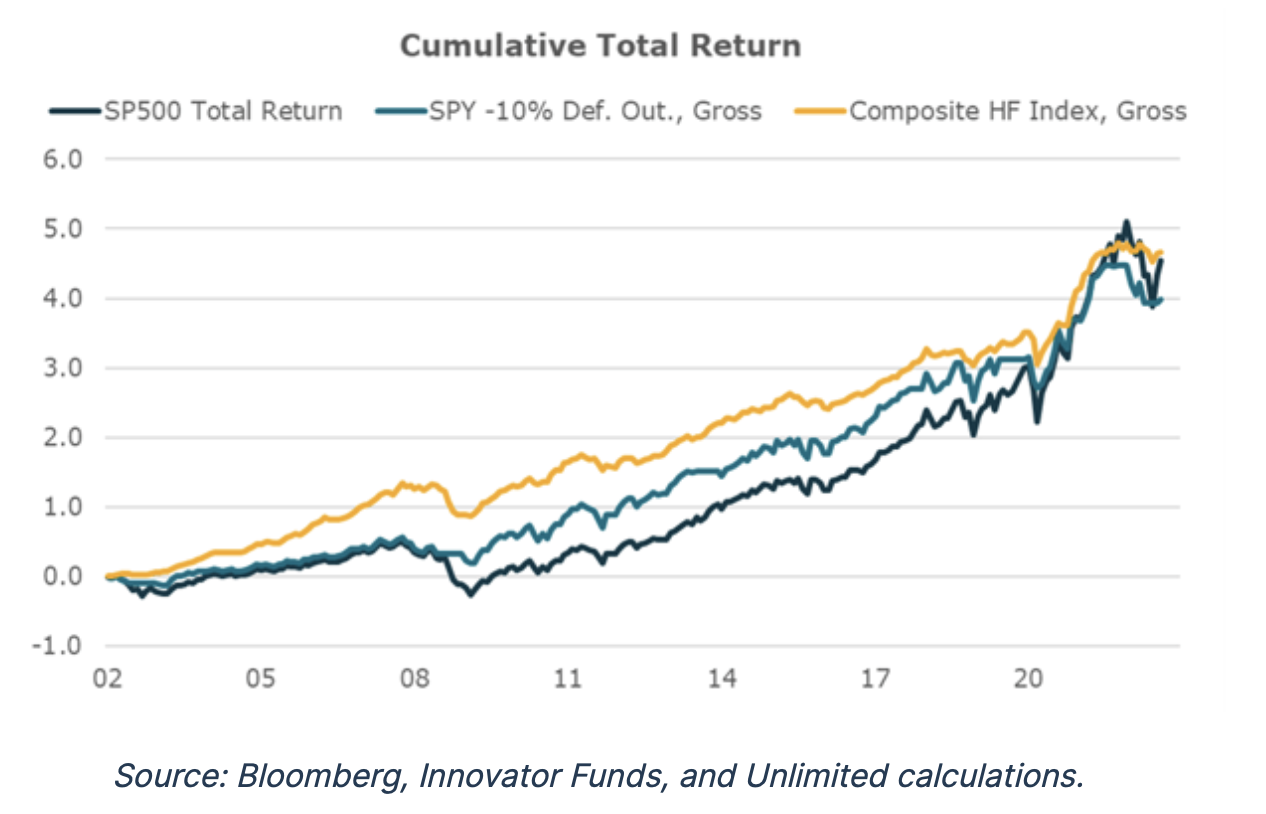

Diversified Alpha is Better Than Constrained Beta

Investors are always looking for a way to reduce their risk while preserving upside. That’s why..

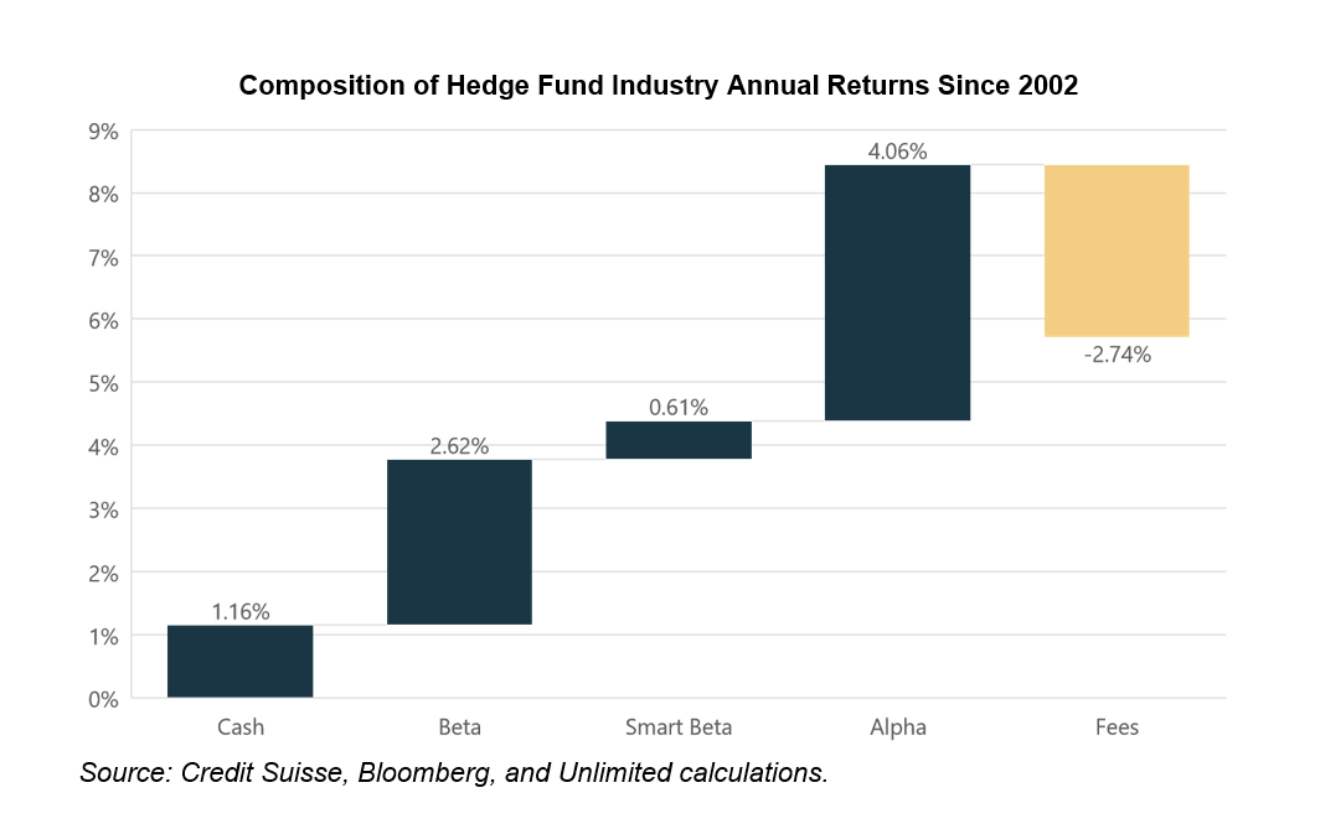

Where Does All The Hedge Fund Alpha Go?

The vast majority ends up in managers’ pockets. No wonder they have so many yachts. For years…

Hedge Funds Outperform During Recessions

During recessionary periods, it’s much better to hold hedge funds than it is to have a traditional 60/40 mix..

Repeating Bogle’s Folly with Hedge Funds

Low cost index funds yield better returns than a portfolio of high cost managers. What was seen…