By Bob Elliott January 1, 2026

The US economy enters 2026 in a more fragile state than in many years. Strict immigration restrictions, weak hiring demand, and tariff hikes have eroded both household income growth and real spending power. Growth support from the AI investment boom has slowed, and housing and non-AI investment have continued to contract.

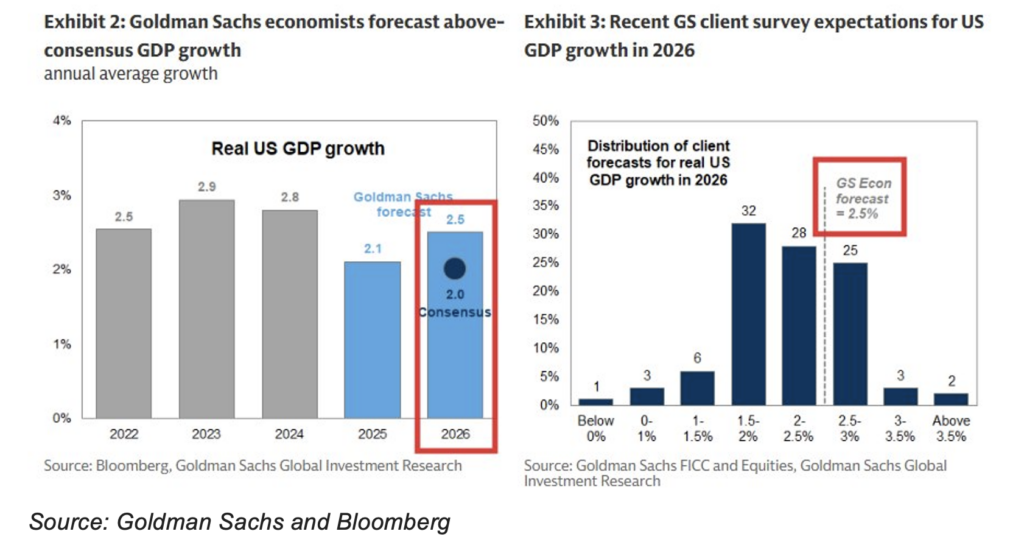

Given this backdrop, achieving the 2-3% real growth rates many investors seem to be indexing on would require a substantial easing of both monetary and fiscal policy in the new year. Unfortunately. based on the current plans this target could prove to be elusive.

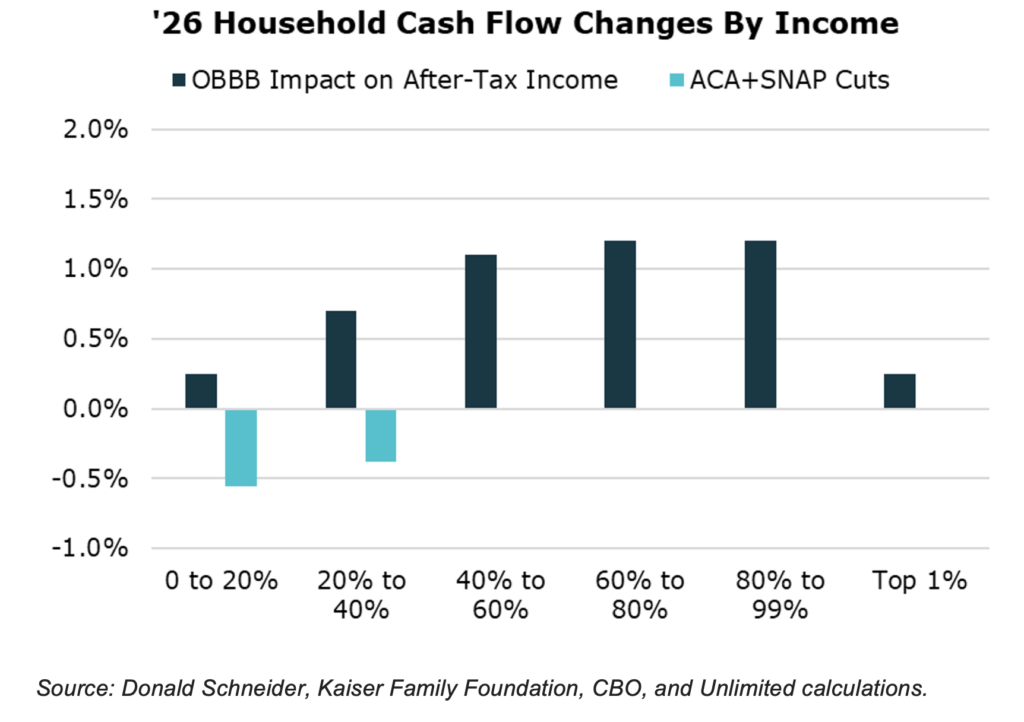

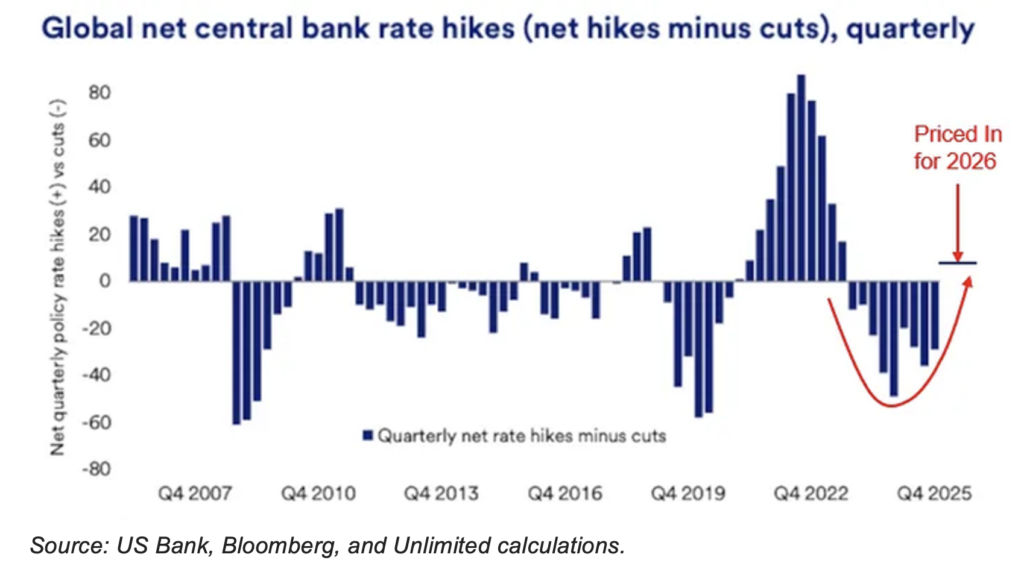

Partisan rhetoric implying the One Big Beautiful Bill (OBBB) will drive a growth boom in 2026 seems to overstate the likely growth support. Modest tax cuts for higher income groups could be largely offset by increased burdens on lower-income workers. A few Fed cuts are expected, but much of the 200bps easing cycle has already been priced in for some time, and the real economy has shown only modest benefit.

This dynamic presents the administration and Fed with a difficult choice in 2026: economic weakness or more stimulus.

The Most Fragile Economy In Years

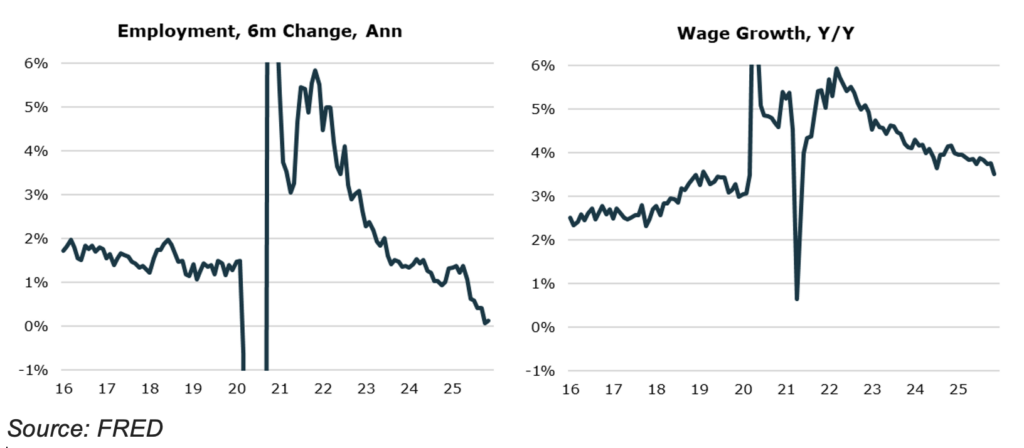

After years of stable, income-driven growth the US economy faces some challenging circumstances heading into 2026. Constrained immigration combined with a gradual softening of the labor markets has significantly reduced both job growth and wage growth – slowing to a roughly 3-3.5% run rate nominal growth as 2025 drew to a close.

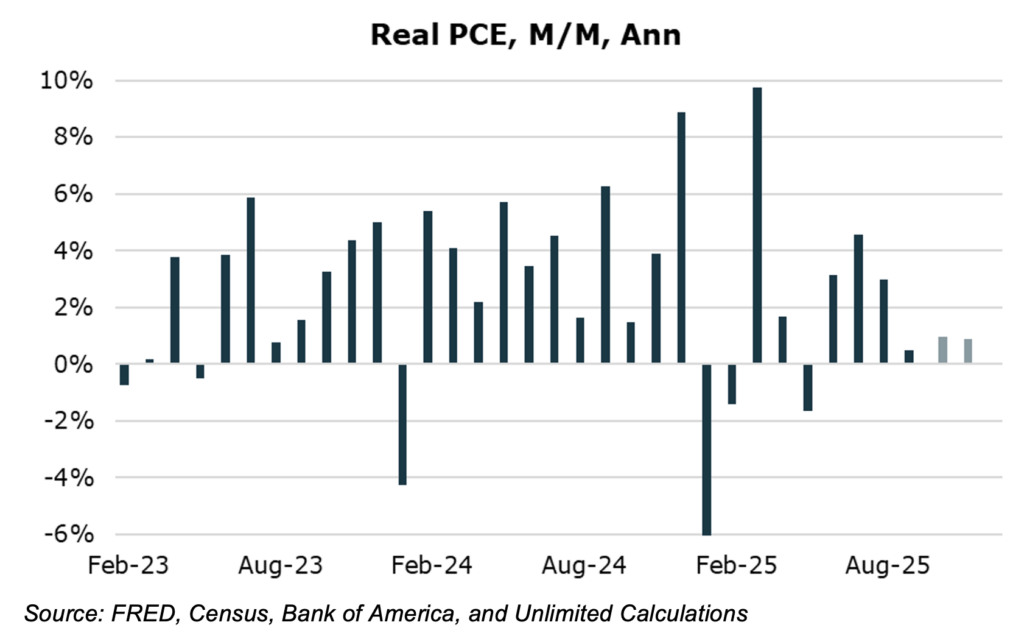

Such weak income growth gives households limited spending power, particularly in an environment with inflation running near 3%. After a brief pop in demand over last summer, timely spending estimates based on retail sales & credit card measures suggest household demand toward year end was at its weakest rate in years.

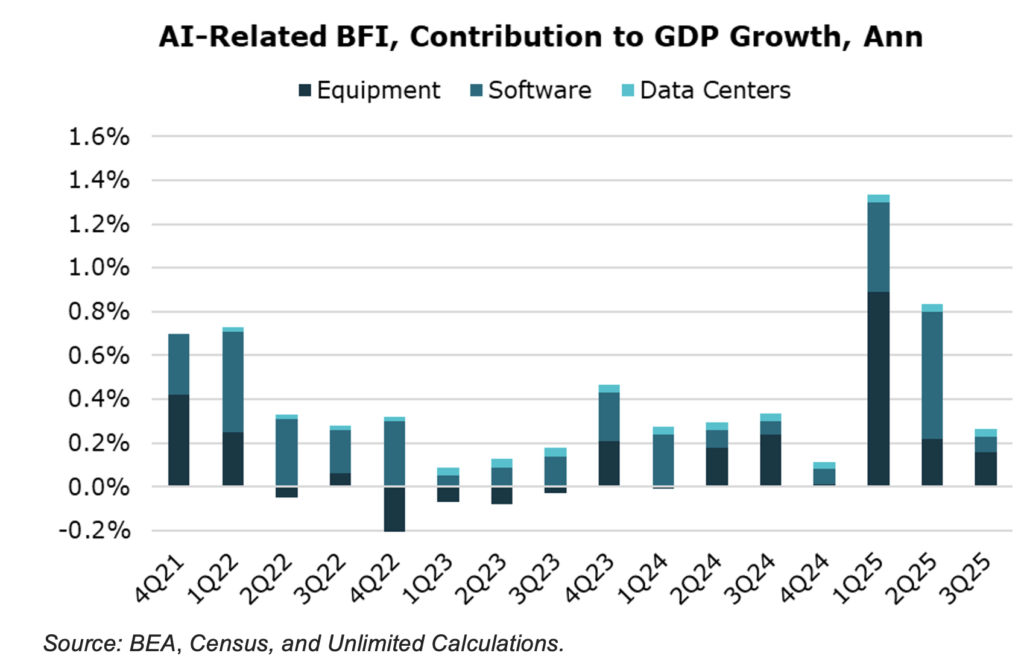

Even the boom in AI related spending on software and equipment appears to be starting to fade. After a surge in investment to frontrun tariffs earlier in the year, the overall AI-invested related contribution to growth has softened considerably.

This combination of pressures postures towards a growth rate ranging around 0-1% in the new year rather than the 2-3% most investors anticipate ahead. Further contraction of growth could put the economy on a knife’s edge with minimal cushion to offer resilience against negative shocks, which might trigger a more self-reinforcing downturn.

Planned Policy Efforts Offer Only Modest Support

Given the decelerating momentum in the economy heading into the new year, achieving strong growth in line with expectations would require a pretty significant expansionary policy response. Current emphasis on potential OBBB related positive impulses ahead could unfortunately be offset by other negative growth policies that have attracted less attention to date.

New measures within the OBBB offer some positive support for households in the new year. The tax bracket increases combined with backdating it to Jan 2025 is expected to create a nearly 50bln increase in refunds, relative to last year, accompanied by a modest lift to post-tax incomes.

The challenge is that much of this benefit targets upper class families which have a much lower propensity to spend than lower-income cohorts. At the same time lower-income families face a challenging combination of rising ACA premiums, reduced reimbursements, and cuts to various social services like SNAP. The net result in 2026 is modest support to HH spending by ~0.25% of GDP.

Monetary policy is also set to offer more muted benefits in the new year as the dividend from disinflation-driven cuts largely fades into history. Many global central banks are now even priced to tighten policy ahead as their next move.

2026 Crossroads: A Choice Between Economic Weakness or More Expansionary Policy

Policymakers face a difficult choice in 2026 given this set of conditions – either accept continued weak economic conditions or pursue expansionary monetary and fiscal policy stimulation and run the economy hot relative to the underlying trend. It’s a difficult crossroad.

Running additional expansionary policy from a fiscal perspective promotes an already large and growing deficit even larger. While there has been discussion around efforts like $2k stimulus checks and additional stimulus from the 2026 reconciliation bill, it’s far from certain that there’s an appetite to run even further deficits.

Amongst the fog, another critical factor is whether the Fed will deliver easier policy than currently priced in, even if the Fed chair is aligned with the administration’s wishes for rapid rate cuts. Regardless of the approach deployed the risk remains that either fiscal or monetary stimulus may force long end rates to rise undesirably, muting any benefit.

On the other hand, failing to provide adequate stimulus risks could allow the economy to languish undesirably in the new year. With unemployment rising and household confidence about the economy at multi-decade lows it may not take much additional weakening to unhinge sentiment, which could create risk of a self-reinforcing negative cycle.

The heightened path dependency may entice investors to go all in on a single path, which could prove perilous in 2026. Navigating the challenging markets ahead requires investor focus on active flexibility and assets where either possible outcome is underpriced.

For informational and educational purposes only and should not be construed as investment advice. It does not constitute an offer to sell or a solicitation of an offer to buy any security. Opinions expressed are our present opinions only. No Representation is being made that any investment will or is likely to achieve profits or losses similar to those shown herein. No investment strategy or risk management technique can guarantee return or eliminate risk in any market environment. The material is based upon information which we consider reliable, but we do not represent that such information is accurate or complete, and it should not be relied upon as such. The historical analysis should not be construed as an indicator of the future performance of any investment vehicle that Unlimited manages. Past performance not indicative of future results.