By Bob Elliott January 13 2026

Over the years at Unlimited we have talked about the prospect of improving portfolio outcomes through either increasing diversification in long-only holdings or by prudently adding tactical alpha strategies that can go both long and short a wide range of assets. But there is a third path that deserves more attention: dynamic leverage.

Folks who have been in the asset management business long enough have witnessed that most financial assets experience long cycles of favor (booms to bubbles) and disfavor (“lost decades”). Such cycles are often initiated by fundamental macro conditions driving the price action which is subsequently reinforced by slower moving sentiment shifts as investors shift allocations. The result is that most financial assets exhibit serial returns correlation to some degree.

Those building strategic portfolios can be well positioned to benefit from these trends by overweighting assets in better return environments and underweighting them in weaker return environments. Even relatively basic approaches that aim to capture this serial correlation when implemented systematically have generated enhanced returns over time. If applied broadly across a strategic savings portfolio the resulting return compounded over years can produce quite an attractive outcome.

Single Asset Dynamic Leverage

The goal of dynamic leverage is relatively straightforward – increase notional positions during periods of higher expected returns and reduce positions during periods expected to deliver weaker returns. Given the serial correlation of asset classes there are many return-based methods that can be employed to capture this idea.

To give a sense of the possible benefit of such strategies, a starting point is to evaluate the impact of a relatively basic 1x12m price action indicator adjustment to leverage on a given asset. The basic approach is if the cumulative total return of the asset is considerably higher than the average of the last 12 months, hold a leveraged position above 100% notional. If it is below, reduce the exposure by holding a portion of cash so that the exposure is below 100% notional. For example a +100%/-50% dynamic leverage would mean notional positions range from +200% to +50%.

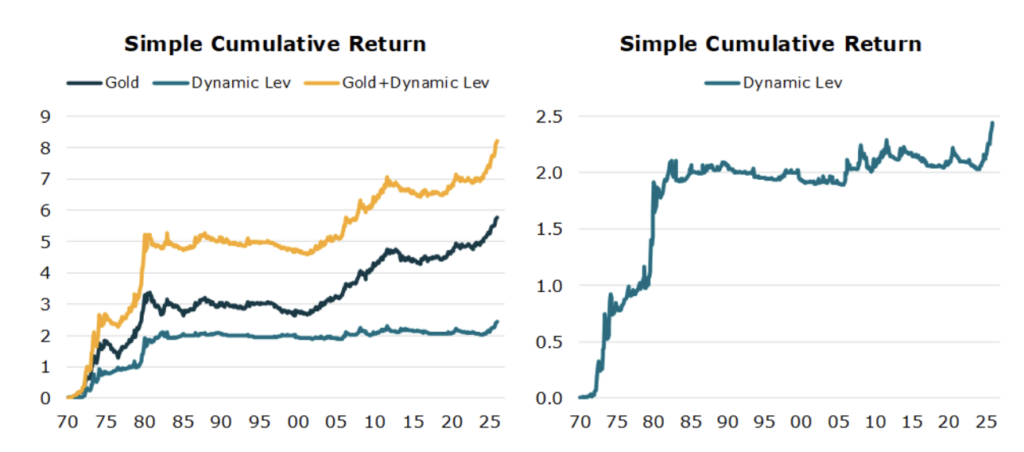

Gold is a good example of how this process works. Historically it has experienced long periods of relatively flat performance punctuated by multi-year periods of very positive performance. Using this approach accentuates those positive performance periods, without creating exaggerated drawdown during the long period of malaise. This would allow investors to capture strong performance without incurring substantial drag related to holding the full position over time.

Source: Yahoo Finance, World Gold Council, FRED and Unlimited calculations.

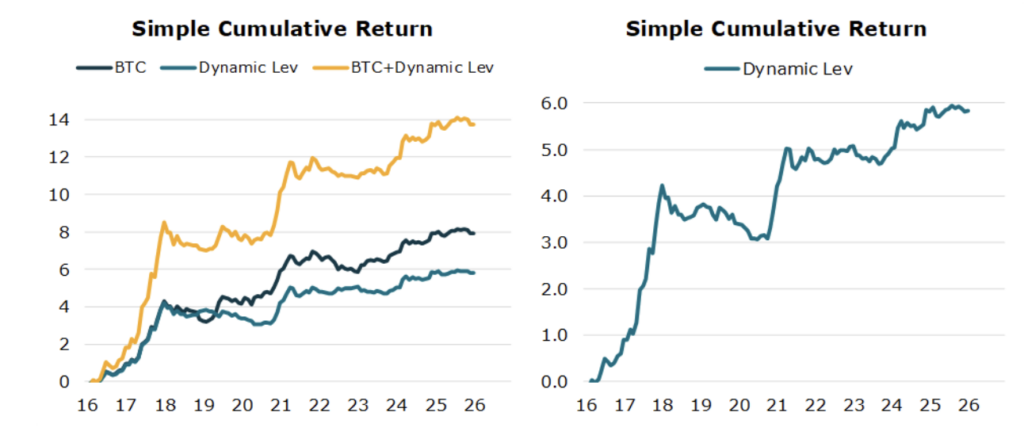

As might be expected, applying a similar approach to a highly speculative asset like Bitcoin with a basic dynamic leverage strategy would have added significant returns over the past decade.

Source: Yahoo Finance, FRED and Unlimited calculations.

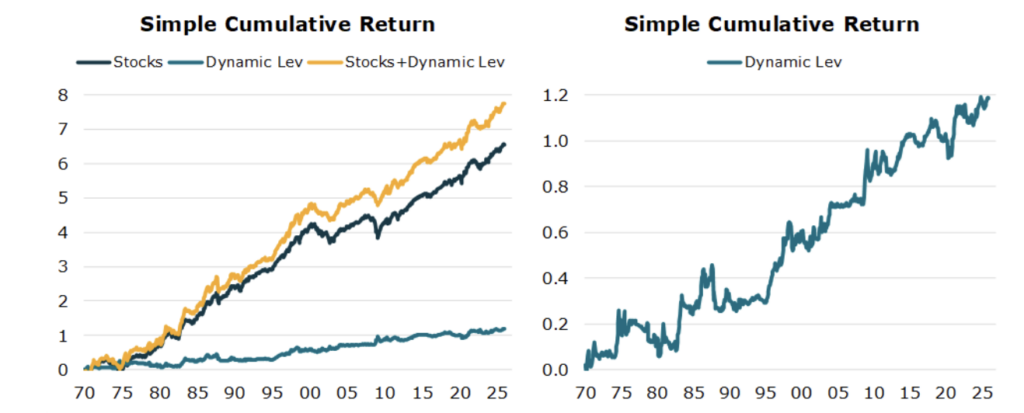

Similar benefits are seen with more traditional assets using the same approach as well. Simple trend following applied to equity market positions has historically generated improved returns over the multidecade timeframe of a strategic portfolio.

Source: Yahoo Finance, Fama & French, FRED and Unlimited calculations.

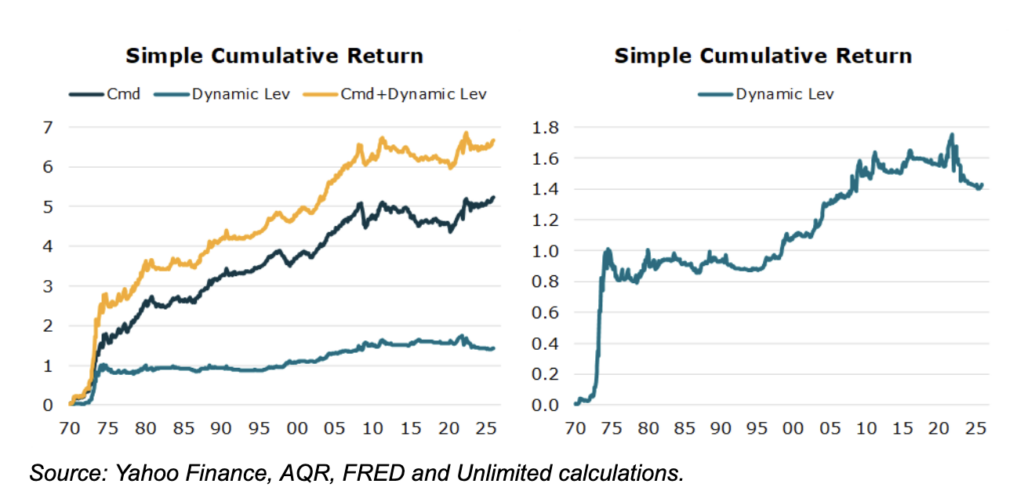

Bond markets also benefit from this approach, particularly during periods of significant rate volatility like in the 80s as well as the pre- and post-covid period.

Source: Yahoo Finance, FRED and Unlimited calculations.

Long positions in diversified commodities experience benefits from varying leverage over time as well, with particularly beneficial results during periods of outperformance like the 70s and more recently the ‘22 period.

Dynamic Trend In An Overall Portfolio

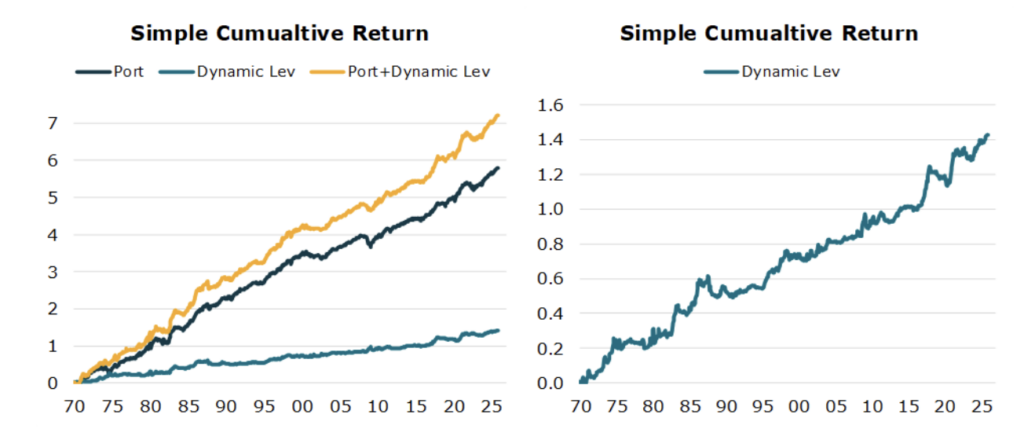

When applied together in a portfolio this simple trend following approach to dynamic leverage has historically improved the returns of a long-only portfolio The example below depicts the results an investor could have achieved with dynamic leverage applied to a portfolio of 50% stocks, 30% bonds, 10% gold, 5% commodities, and 5% bitcoin, when available.

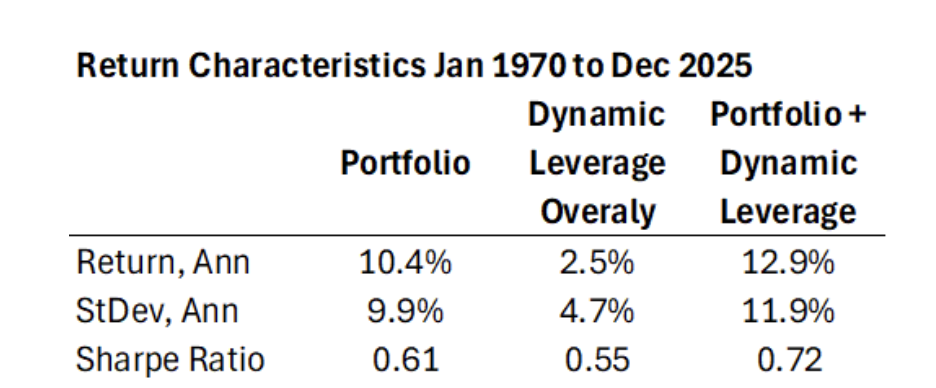

Adding a dynamic leverage overlay to a traditional long only portfolio would have generated improved returns for a strategic portfolio while taking on only a modest amount of incremental risk.

Source: Yahoo Finance, Fama & French, World Gold Council, AQR, FRED and Unlimited calculations.

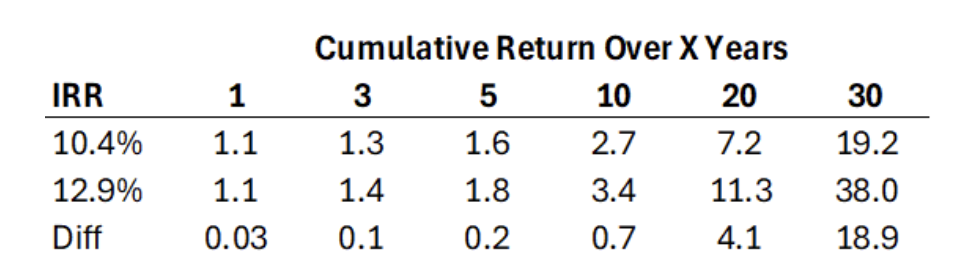

While 250bps annually on average may not seem like much in the moment, the compounded impact of such a strategy over the time horizon of a strategic savings portfolio could lead to a significantly more attractive outcome relative to a long-only portfolio alone.

Source: Yahoo Finance, Fama & French, World Gold Council, AQR, FRED and Unlimited calculations.

For informational and educational purposes only and should not be construed as investment advice. It does not constitute an offer to sell or a solicitation of an offer to buy any security. Opinions expressed are our present opinions only. No Representation is being made that any investment will or is likely to achieve profits or losses similar to those shown herein. No investment strategy or risk management technique can guarantee return or eliminate risk in any market environment. The material is based upon information which we consider reliable, but we do not represent that such information is accurate or complete, and it should not be relied upon as such. The historical analysis should not be construed as an indicator of the future performance of any investment vehicle that Unlimited manages. Past performance not indicative of future results.

Simulated, back-tested, modeled, or hypothetical performance results have many inherent limitations, some of which are described below. No representation is being made that any account will, or is likely to, achieve profits or losses similar to those shown. In fact, there are frequently sharp differences between hypothetical performance results and the actual results subsequently achieved by any particular trading program. There can be no guarantee that during times of extreme market conditions any investor will be able to execute the trades that should be made. This may have an effect on the performance achieved. No representation or warranty is made as to the reasonableness of the assumptions made or that all assumptions used to construct the performance have been stated or fully considered. To the extent that the assumptions made do not reflect actual conditions, the illustrative value of the simulated results will decrease. One limitation of hypothetical performance results is that they are generally prepared with the benefit of hindsight. In addition, hypothetical trading does not involve financial risk, and no hypothetical record can completely account for the impact of financial risk in actual trading. For example, the ability to withstand losses or adhere to a particular trading program in spite of trading losses are material points which can also adversely affect actual trading results. There are numerous other factors related to the markets in general or the implementation of any specific trading program which cannot be fully accounted for in the preparation of hypothetical performance results and can adversely affect actual trading results. The timeframe selected for the back-test reflects the post gold standard period. Displayed net of ETF fees incurred to hold the investment assets but does not include third party portfolio management or performance fees.