Published by Bob Elliott July 21, 2025

With nearly $10tln invested in actively managed equity mutual funds and ETFs and another $1.5tln in Equity Long/Short hedge funds it seems nearly most investors, advisors, and allocators are searching for an equity manager that can consistently outperform. As many folks have learned through time, the vast majority of those managers end up underperforming passive index investing despite charging higher fees.

Rather than trying to find the ever so elusive single manager that could deliver outperformance (which is very challenging to do), a more effective strategy may be to create a diversified portfolio of top equity managers while focusing on incurring lower fees to access those returns; an approach we call Alpha Indexing. Taking this approach with Equity Long/Short Hedge Fund managers appears to offer a compelling alternative to achieve more consistent equity outperformance than other options available.

The challenge for allocators investing in Equity Long/Short Hedge Funds is that managers typically run their strategies at bond-like risk to fulfill the mandates of institutional clients. So, while they have often generated alpha, on a risk-adjusted basis (particularly before fees) their reported performance often appears to trail index returns making these solutions a poor substitute for equity risk in a portfolio. Further, the high fees many of these managers charge erodes the majority of the alpha ultimately realized by the end investor.

With the recent increase in the range of product offerings investors don’t have to settle for the inefficiency of low target returns. Structural options exist to create products that can relatively easily target twice the notional positions of the manager’s capital. This can lead to a strategy that offers equity index-like risk with higher target returns, while preserving a similar return profile with lower fees than the typical 2 & 20 fees incurred by private fund investors.

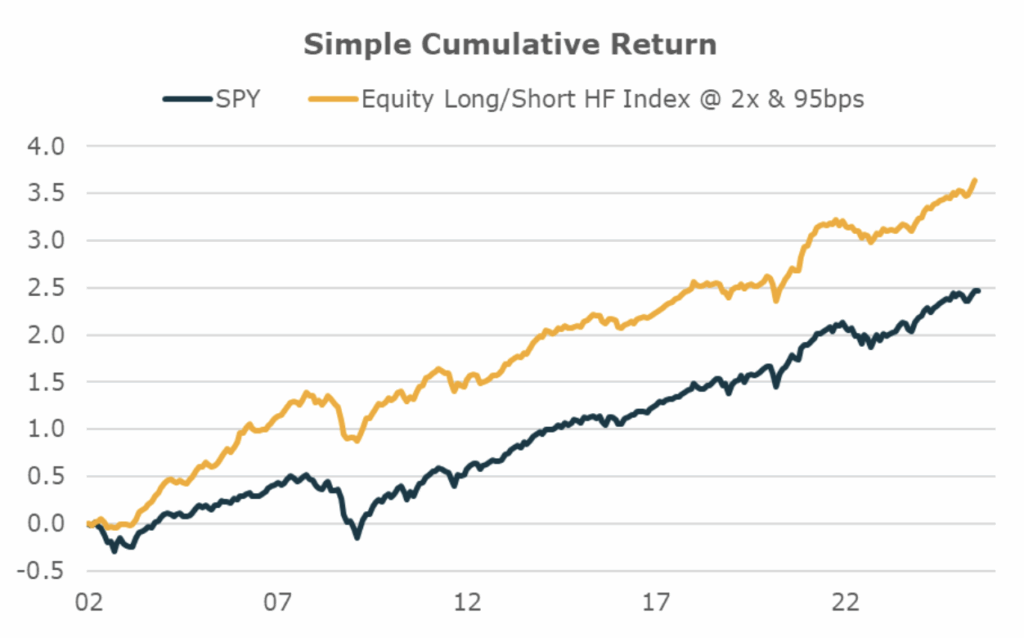

The chart below compares the returns of the SPY ETF with a higher target return version (in this case 2x) of Equity Long/Short alpha at a lower fee point (in this case 95bps/yr). As depicted below, the resulting cumulative return would have consistently outpaced SPY.

The results depicted are aggregated results and do not represent returns that an investor attained. Past performance not indicative of future results. Sources: Yahoo Finance, Barclayhedge, Bloomberg, Credit Suisse, HFR and Unlimited calculations.

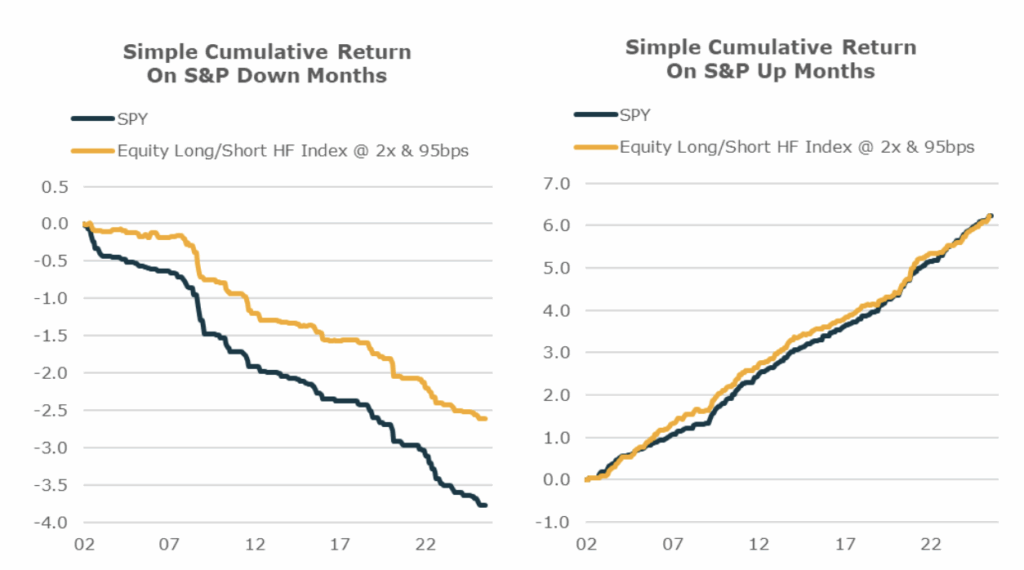

The primary driver of Equity Long/Short managers’ outperformance is their ability to play defense well. As the charts below highlight, the 2x target return strategy can maintain similar upside returns as index investing during positive market environments but enhanced by outperformance sourced from limiting the losses during down markets.

The results depicted are aggregated results and do not represent returns that an investor attained. Past performance not indicative of future results. Sources: Yahoo Finance, Barclayhedge, Bloomberg, Credit Suisse, HFR and Unlimited calculations.

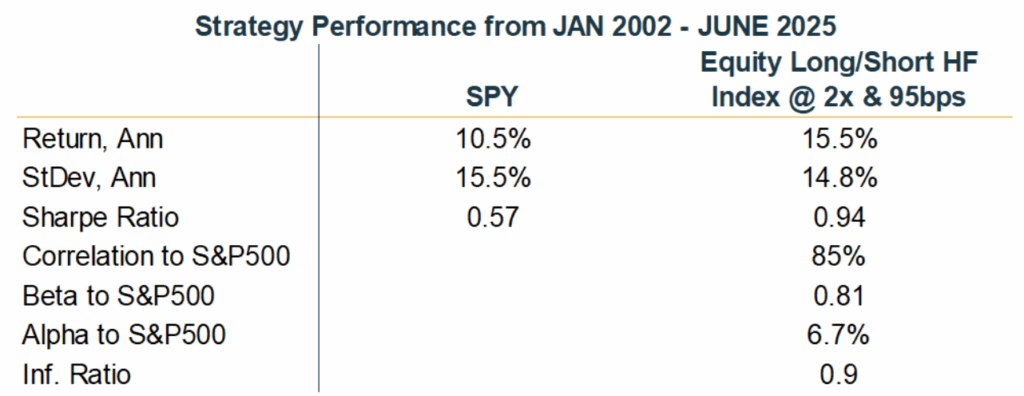

This 2x lower fee Equity Long/Short strategy would have experienced similar monthly return volatility as index investing but delivered higher returns and alpha along with shallower drawdowns driven by the dynamics described above.

The results depicted are aggregated results and do not represent returns that an investor attained. Past performance not indicative of future results. Sources: Yahoo Finance, Barclayhedge, Bloomberg, Credit Suisse, HFR and Unlimited calculations.

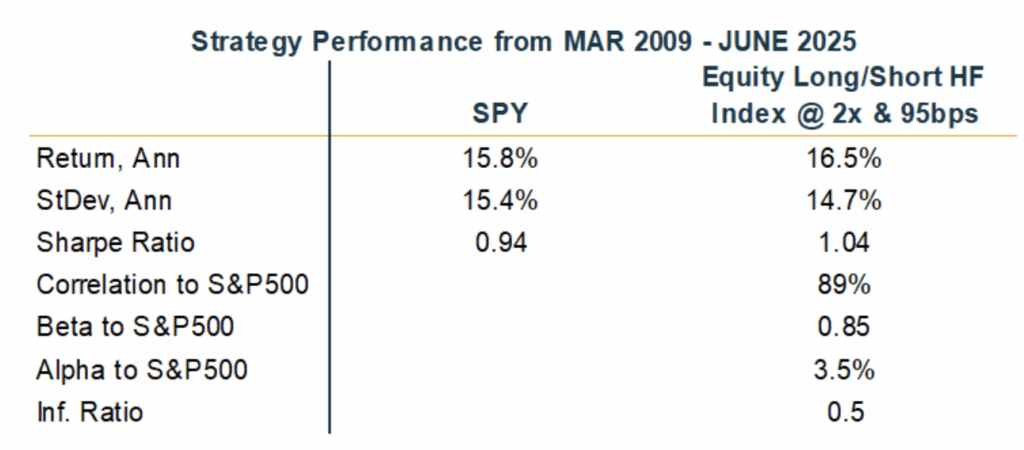

While these managers shine in down market environments weak asset returns are not required for them to generate alpha. Even during a prolonged period of upside returns like the last 15 years, holding a 2x Equity Long/Short Hedge Fund strategy at lower fees would have produced meaningful alpha relative to direct index investing, with the table below showing the performance since the start of the post-GFC persistent equity bull market.

The results depicted are aggregated results and do not represent returns that an investor attained. Past performance not indicative of future results. Sources: Yahoo Finance, Barclayhedge, Bloomberg, Credit Suisse, HFR and Unlimited calculations.

Many allocators eschew the concept of low-cost alpha indexing approaches like what is described above with the hope that they can find individual managers that will outperform their peers. But over time, a lower cost indexing approach to investing in managers creates a higher probability outperformance relative to peers. That is a product of the inherent diversification benefits of an index approach which can improve return consistency, paired with a lower fee structure allowing the investor to harvest more of the alpha generated.

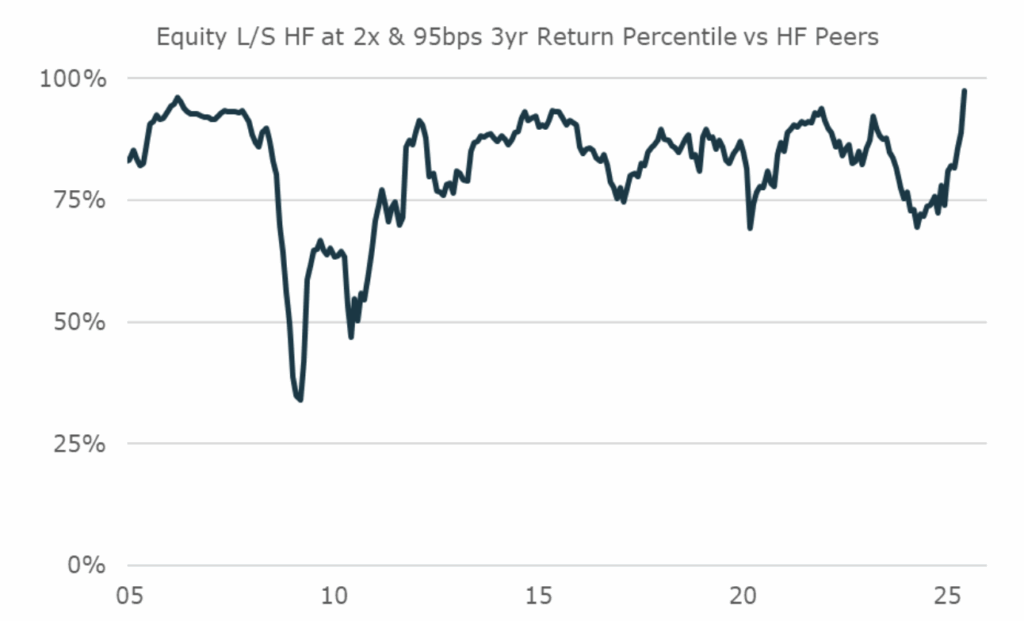

As depicted in the chart below over the past two decades, an Equity Long/Short Hedge Fund strategy run at a higher target return charging a lower fee would have generated consistently above median returns without the substantial diligence burden that comes with selecting individual managers.

The results depicted are aggregated results and do not represent returns that an investor attained. Past performance not indicative of future results. Sources: Yahoo Finance, Barclayhedge, Bloomberg, Credit Suisse, HFR and Unlimited calculations.

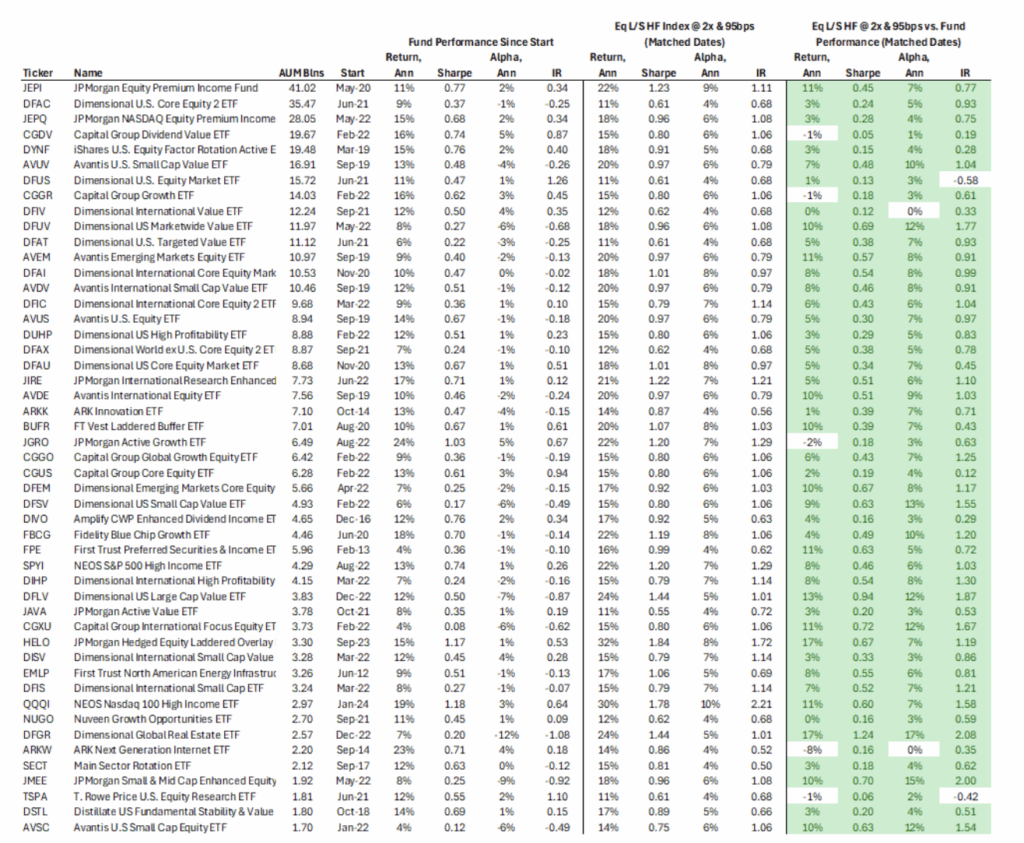

Lower cost Alpha Indexing of Equity Long/Short Hedge Fund managers may also offer differentiated returns relative to other actively managed equity strategies currently available to investors in the ETF wrapper. The table below compares the top 50 (by AUM) actively managed equity ETFs in the market today, to the returns of the Equity Long/Short Hedge Fund Index at 2x and 95bps shown above over matched time periods.

Past performance not indicative of future results. Sources: Yahoo Finance, Barclayhedge, Bloomberg, Credit Suisse, HFR and Unlimited calculations.

The combination of high fees and low target returns have historically caused many investors to look past Equity Long/Short Hedge Fund strategies as a way to create differentiated returns in their equity allocations. But the thoughtful integration of leverage paired with fee reduction through indexation could create a compelling return profile for those investors seeking active equity allocations.

With equity indexes near all-time highs, this may be an opportune time to consider adding such strategies that can offer attractive returns in an up market but can also generate alpha as they encounter more challenging market environments.

For informational and educational purposes only and should not be construed as investment advice. The historical analysis discussed herein has been selected solely to provide information on the development of the research and investment process and style of Unlimited. It does not constitute an offer to sell or a solicitation of an offer to buy any security. Opinions expressed are our present opinions only. No Representation is being made that any investment will or is likely to achieve profits or losses similar to those shown herein. No investment strategy or risk management technique can guarantee return or eliminate risk in any market environment. The material is based upon information which we consider reliable, but we do not represent that such information is accurate or complete, and it should not be relied upon as such. The historical analysis should not be construed as an indicator of the future performance of any investment vehicle that Unlimited manages.