Published By Bob Elliott on April 8, 2025

The market turmoil to kick off ‘25 has many investors considering adding diversifying strategies to those traditional 60/40 portfolios that have done well in recent years. As we scan the universe of underappreciated diversifying strategies, Global Macro alpha stands out as one of the most compelling complements for many portfolios.

These managers typically take long and short positions across major liquid currency, commodity, fixed income, equity index, and credit markets, looking for the biggest opportunities agnostic to geography or asset class. This approach gives these managers the opportunity to generate alpha independent of the direction of the US equity and bond markets, decreasing the correlation to traditional long only strategies.

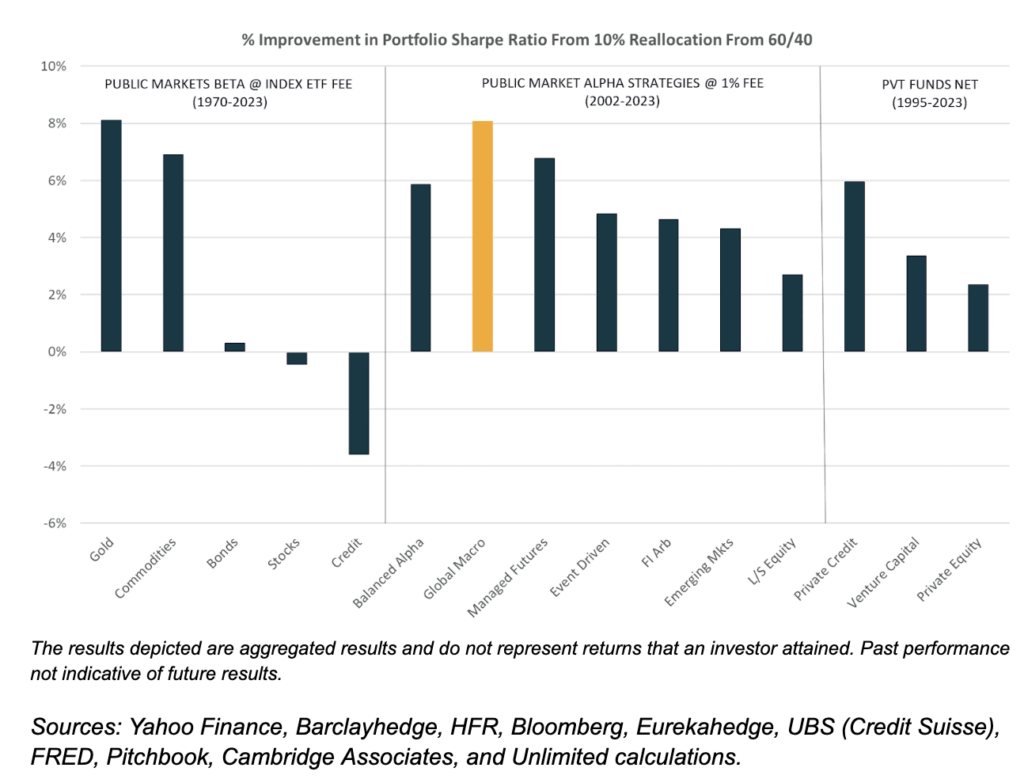

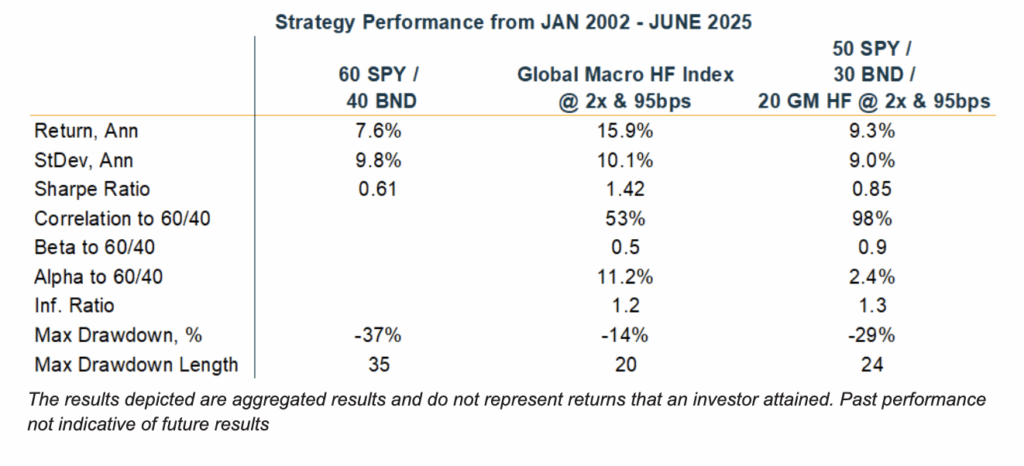

The chart highlights the benefit of Global Macro strategies in the context of a range of possible additions to a traditional 60/40 portfolio. Over the last couple decades, an incremental allocation to global macro alpha has offered a strong improvement in the risk/return of a traditional 60/40 portfolio, particularly if that return can be accessed with less fee drag than typical 2&20 costs.

One challenge everyday investors face is many Global Macro managers offer their strategy as a bond alternative which can lead to low target returns relative to other portfolio assets like stocks. These lower target volatility returns also tend to require a much larger capital investment to achieve meaningful diversification benefits at the portfolio level which leads to line-item risks for allocators.

But investors don’t have to settle for these low target returns as given. Structural options exist to create products that can relatively easily target twice the notional positions of the manager’s capital leading to higher target returns and greater cash efficiency while preserving a similar return profile.

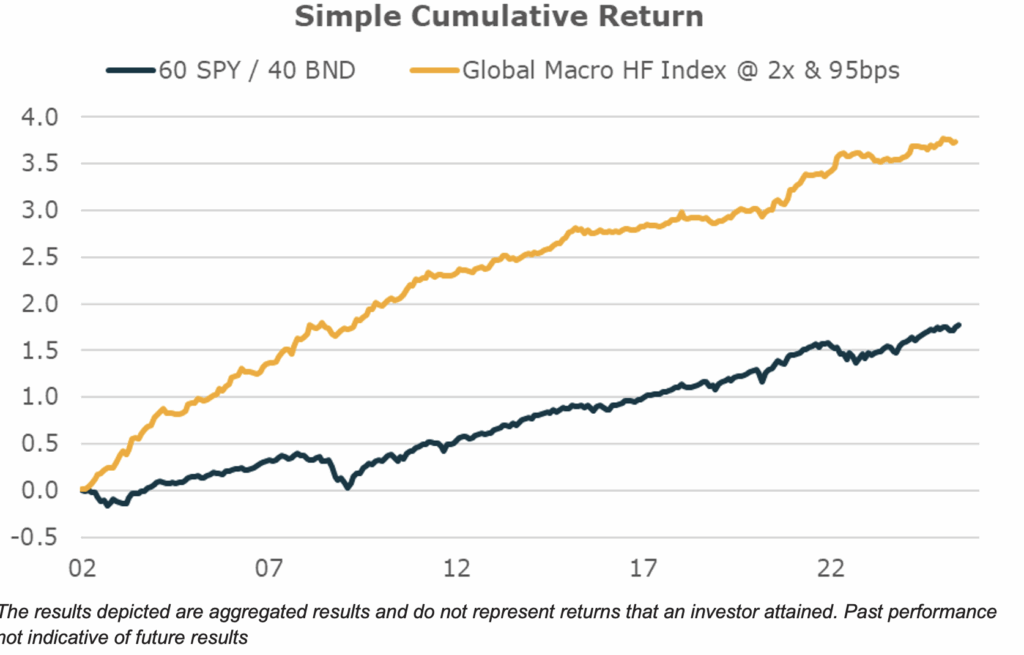

The chart below compares a higher target return version (in this case 2x) at a lower fee point (in this case 95bps/yr) for Global Macro alpha relative to the standard 60/40 portfolio. As depicted below, the resulting cumulative return would have consistently outpaced 60 / 40.

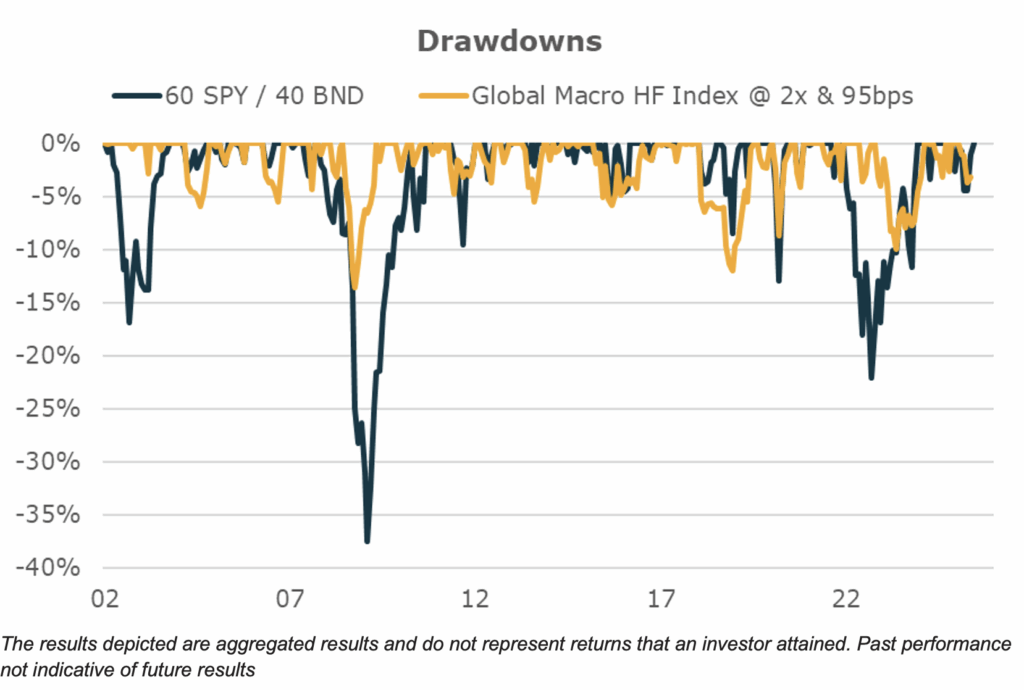

Returns that outpace 60/40 have come with similar monthly volatility, and potentially more importantly, more limited drawdowns versus a long-only 60/40 strategy.

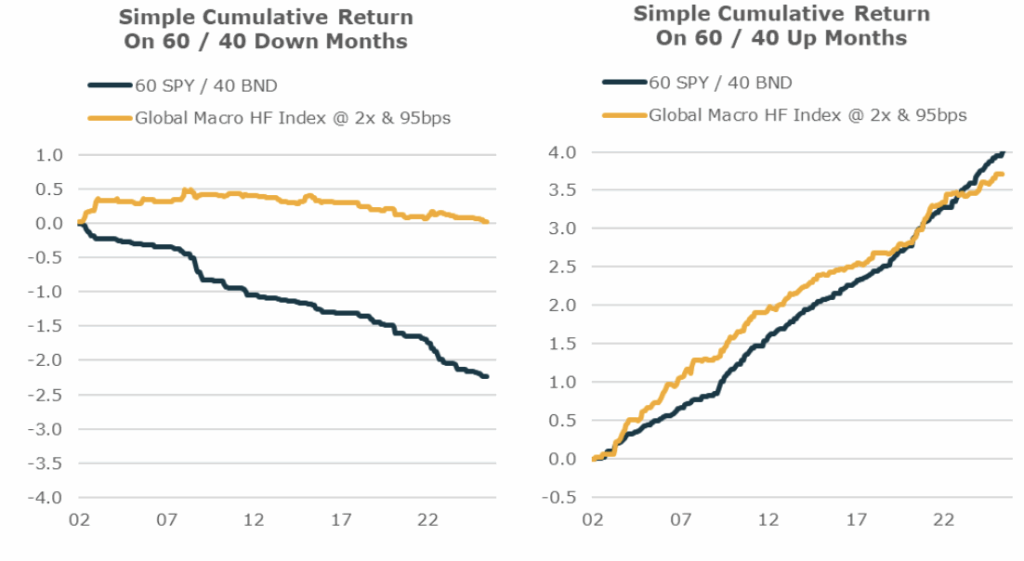

The complimentary attributes can create a strategy with the ability to maintain value during challenging market environments and generate positive returns during positive market environments. That is a return profile that many hedge funds strive to achieve – full cycle returns with attributes that can help limit downside, rather than generating outsized upside in buoyant markets.

The results depicted are aggregated results and do not represent returns that an investor attained. Past performance not indicative of future results.

Over the last couple of decades, Global Macro managers have shown their value as a complement to 60/40 portfolios. Recently hedge fund strategies have become more accessible via the ETF wrapper, offering investors access to that alpha at 95bps of fees, rather than the typical 2 & 20, paired with improved liquidity and transparency.

Had an investor allocated 20% to the above-modeled Global Macro strategy from the period of 2002 to present their experience would include: improved performance, lower volatility, and less meaningful drawdowns in depth and duration. Arguably a pretty attractive combination of diversification benefits.

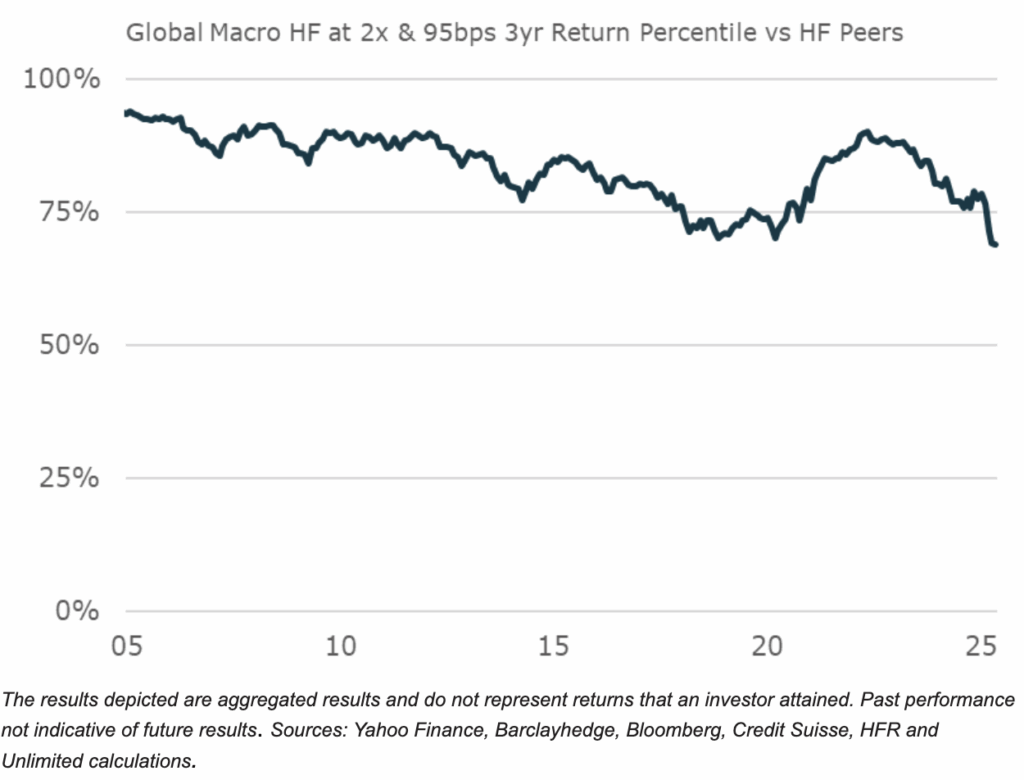

Many allocators eschew the concept of low-cost alpha indexing approaches like what is described above with the hope that they can find individual managers that will outperform their peers. But over time, a lower cost indexing approach to investing in managers creates a higher probability outperformance relative to peers. That is a product of the inherent diversification benefits of an index approach which can improve return consistency, paired with a lower fee structure allowing the investor to harvest more of the alpha generated.

As depicted in the chart below over the past two decades, a Global Macro strategy run at a higher target return charging a lower fee would have generated consistently above median returns without the substantial diligence burden that comes with selecting individual managers.

With increasing questions about the durability of the US equity rally, it seems to be an opportune time for allocators to consider adding Global Macro alpha to their portfolio. While there are hundreds of managers out there, the key is getting enough diversification to not be overly exposed to a single manager and find structures with low fees so that the alpha generated benefits the end investor.

For informational and educational purposes only and should not be construed as investment advice. The historical analysis discussed herein has been selected solely to provide information on the development of the research and investment process and style of Unlimited. It does not constitute an offer to sell or a solicitation of an offer to buy any security. Opinions expressed are our present opinions only. No Representation is being made that any investment will or is likely to achieve profits or losses similar to those shown herein. No investment strategy or risk management technique can guarantee return or eliminate risk in any market environment. The material is based upon information which we consider reliable, but we do not represent that such information is accurate or complete, and it should not be relied upon as such. The historical analysis should not be construed as an indicator of the future performance of any investment vehicle that Unlimited manages. Sources: Yahoo Finance, Barclayhedge, HFR, Bloomberg, Eurekahedge, UBS (Credit Suisse), FRED, Pitchbook, Cambridge Associates, and Unlimited calculations.