Published by Bob Elliott and Nathan Nangia on November 12, 2024

We’ve written several pieces about hedge fund persistence and the potential benefits of hedge fund indexation over the last few years (Elusive Persistence). Our conclusion is random chance is approximately as effective as allocators’ at selecting a hedge fund portfolio. The research supports that allocators could generate a more attractive return by investing in an index of hedge funds than an actively managed portfolio, particularly if they can access those returns with lower fees.

These conclusions were drawn based on rigorous analysis of the last decade of performance, but some folks who have allocated to hedge funds for a few decades remain skeptical about the conclusion. They remember a time when there was enough divergence between funds that selection based on attributes like historical returns or Sharpe ratio could result in an attractive portfolio return. And they are right – there are indications that during the golden age of the hedge fund industry picking worked for a targeted period, albeit relatively short.

Unfortunately, that may be an artifact of the past, as the surge of new funds compressed performance dispersion.

The Golden Age of Hedge Funds and Allocator Picking

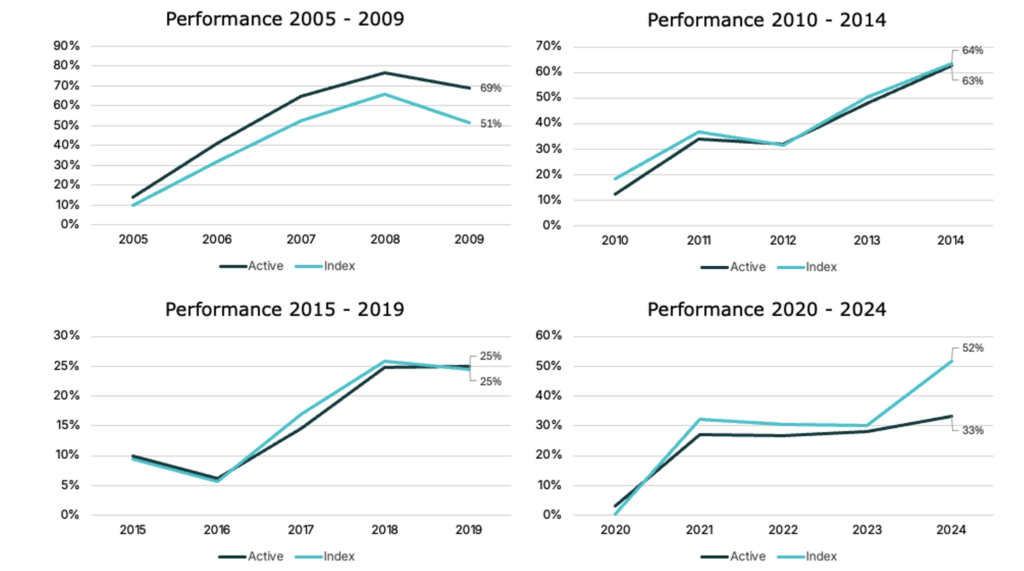

To provide perspective, we compared a simple allocation with an index of hedge fund returns in 5-year periods since 2000. The allocation formula was as follows: invest in the funds with a Sharpe ratio in the top quartile from the previous year in equal weight, hold for one year, and then rebalance. Frequent readers of our blog will recognize this allocation approach – we applied a similar approach (and discussed its drawbacks) in previous posts.

The results depict there was a time when allocators earned material alpha from their research, but that alpha seems to have eroded over time, and, if anything, active selection appears to have created a performance drag in recent years.

Note: Performance was calculated based on a fiscal year ending in May to incorporate the most recently available data for 2024.

Source: Preqin, Unlimited Calculations

Increasing Performance Compression Across Managers Over Time

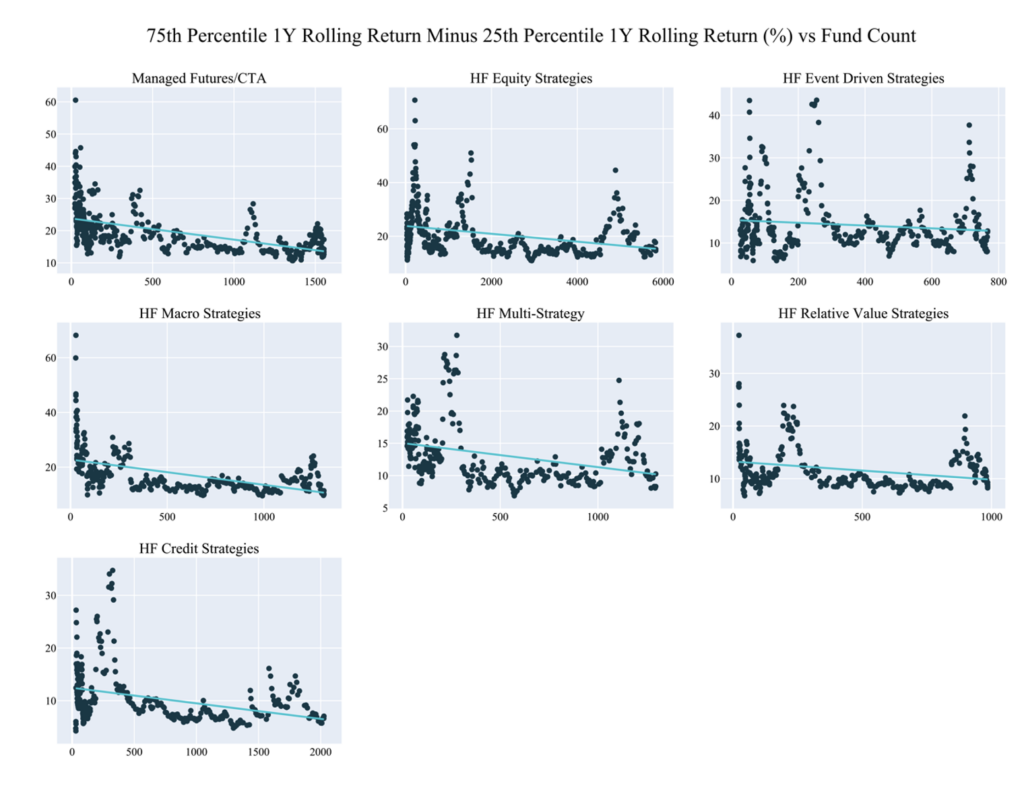

A material driver of allocators’ challenge has come from reduced performance dispersion between individual hedge fund managers, regardless of fund style. The chart below includes a regression of the interquartile range of returns with the number of funds in a given sub-strategy. The relationship between the two is statistically significant, implying that hedge fund performance has shown evidence of “alpha decay” over the last few decades. The economic intuitions for performance decaying seem apparent – ‘crowding’, ‘competition’, etc. – and the implications for allocators could be significant. Alpha decay implies that the benefits of research and diligence for fund selection have declined over the years while the benefits of indexation appear to have remained constant.

Source: Preqin, Unlimited Calculations

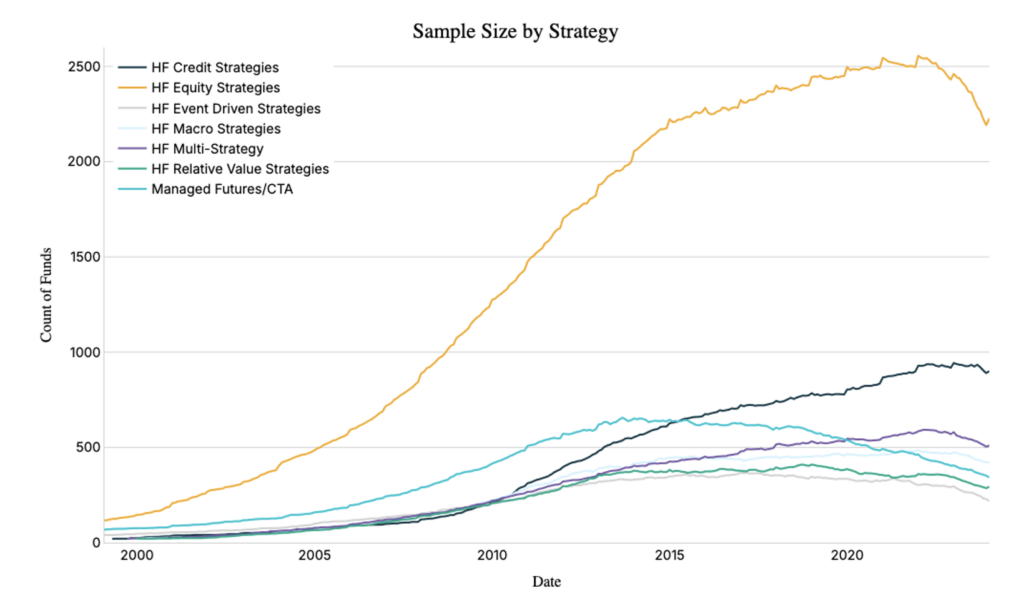

This compression of performance between managers shouldn’t be all that surprising given the attractiveness of the hedge fund business model for managers. New fund entrants have surged over time, particularly during the golden age of hedge fund performance just prior to the global financial crisis. As more and more funds entered the market, alpha dispersed across managers, reducing individual manager performance dispersion.

Note: This chart counts the number of funds with returns data in the Preqin dataset. Reporting returns to Preqin is voluntary, and therefore, underperforming managers may not be incentivized to report results in a timely manner. However, reporting from Bloomberg and other sources indicates that there may have been more liquidations than new launches in recent years.

Source: Preqin, Unlimited Calculations

In More Competitive World, Costs Matter

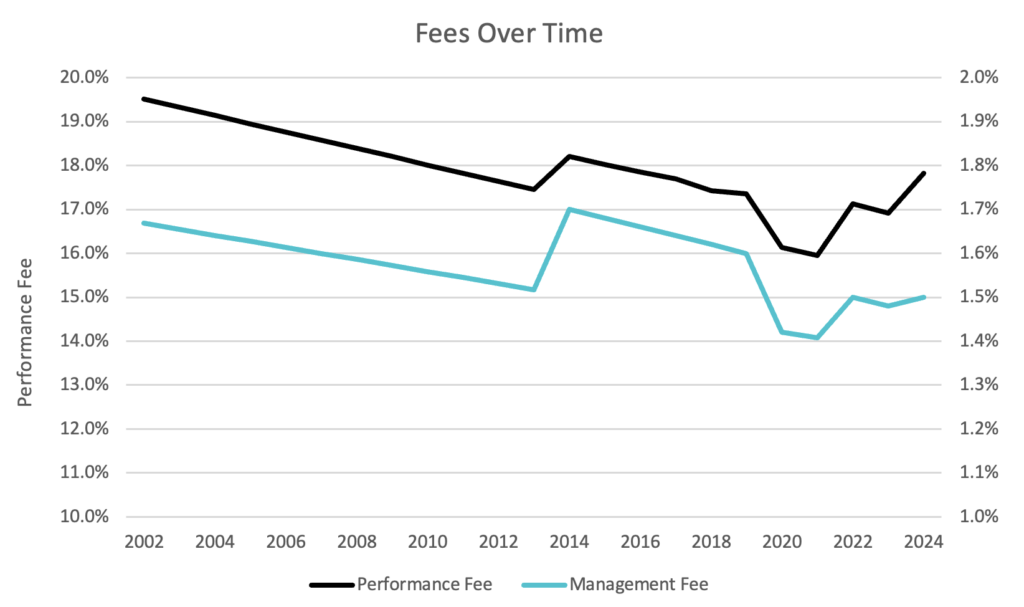

Despite increased competition among hedge funds, the cost to access “alpha” returns (i.e., fees) has not declined, in part due to significant allocator demand. Instead, in recent years, “all in” costs appear to have spiked due to the advent of “pass-thru” cost structures. Meanwhile, capital lockups have also increased.

Sources: BNP Paribas, Bloomberg, Unlimited Calculations

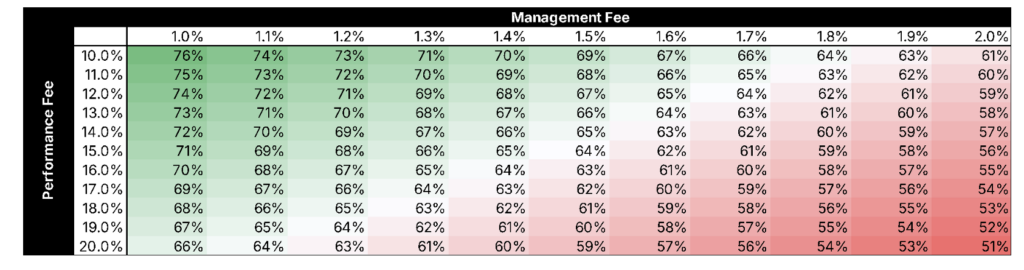

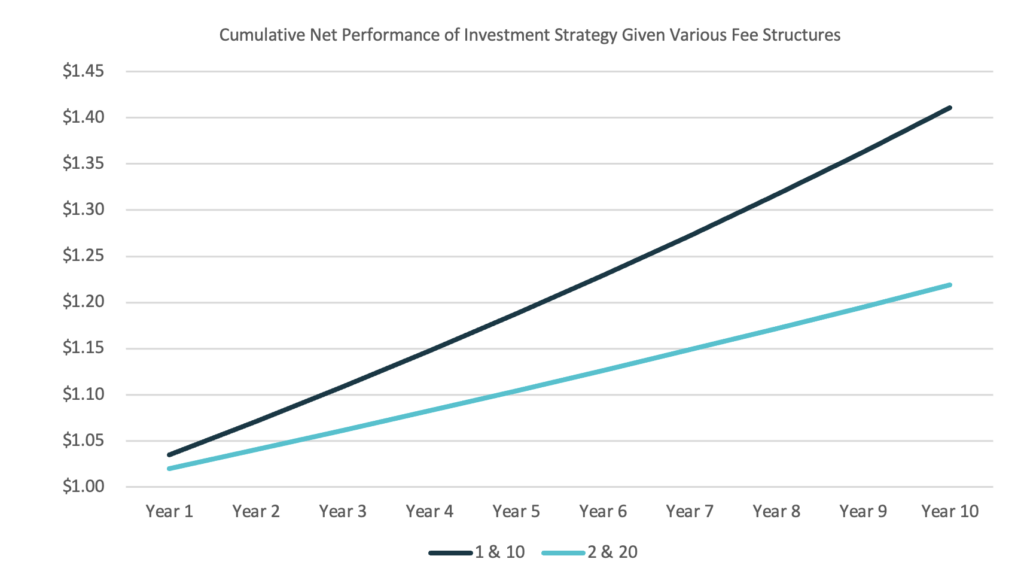

Quick math suggests that allocators today can only expect to experience about ~55-60% of the gross gains from investing in a hedge fund. That is for every dollar earned, gross of fees, the investor would ultimately receive roughly $0.55-60, net of fees. It becomes increasingly difficult to justify this fee burden when coupled with substantive lockup periods, in some cases as high as five-to-seven-years. Allocators have the opportunity to harvest up to 30% more of the return by lowering their fee burden! If fees are not decreasing and managers are charging those fees for longer, the compounded long-term economics of investing in an actively selected portfolio of hedge funds dramatically deteriorates.

Percent of Gross Return Earned by Allocator Per Year

Source: Unlimited Calculations

Amongst the litany of challenges allocators face it appears: 1) the alpha realized by the investor from actively selecting a hedge fund portfolio has eroded as competition increased and 2) the costs of selecting an active portfolio have not yet declined commensurately. Meanwhile, index-style strategies have emerged which may offer an attractive lower-cost alternative to actively managed portfolios.

For informational and educational purposes only and should not be construed as investment advice. The historical analysis discussed herein has been selected solely to provide information on the development of the research and investment process and style of Unlimited. It does not constitute an offer to sell or a solicitation of an offer to buy any security. Opinions expressed are our present opinions only. No Representation is being made that any investment will or is likely to achieve profits or losses similar to those shown herein. No investment strategy or risk management technique can guarantee return or eliminate risk in any market environment. The material is based upon information which we consider reliable, but we do not represent that such information is accurate or complete, and it should not be relied upon as such. The historical analysis should not be construed as an indicator of the future performance of any investment vehicle that Unlimited manages.