Published by Bob Elliott on May 12, 2022 10:02:59 PM

Global macro style hedge fund strategies are having their best performance in decades. Index returns were 18% in the first quarter before fees, and it looks like April was strong as well. The strong returns from global macro managers was predictable coming into the year. Unlimited’s return replication technology, which uses machine learning to infer manager positioning, projected before the year started that these funds were holding sizable positions long gold, energy, and other commodities while holding short positions in the bond market. Investors following this positioning indicated by Unlimited’s technology would have experienced nearly 90% of the subsequent index return. Not too bad considering index returns were nearly 2x stronger than any quarter in the last 20 years.

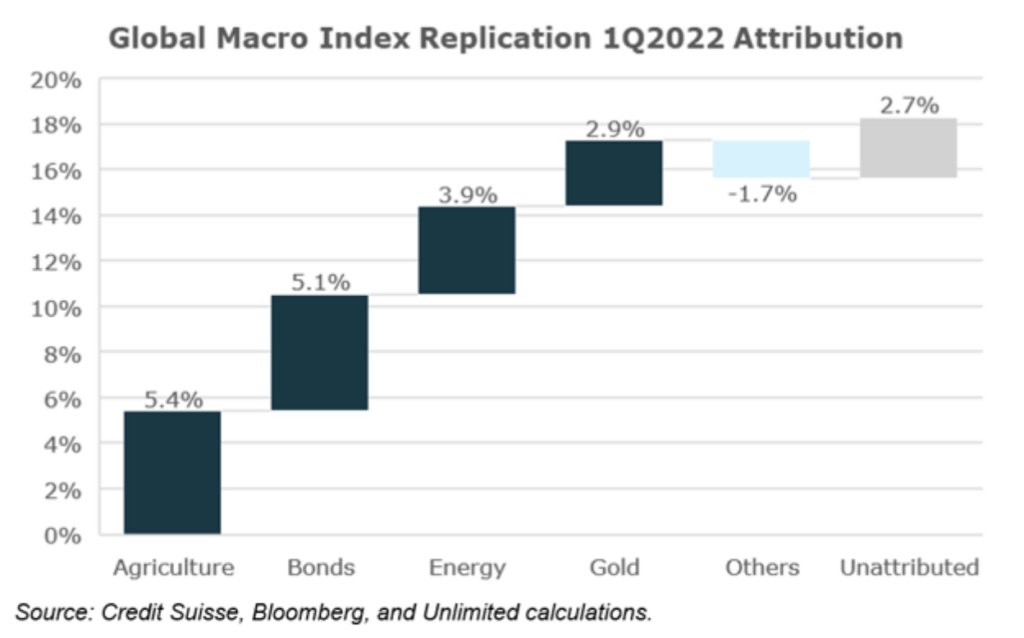

The waterfall chart below gives perspective on Unlimited’s estimates of what contributed to macro managers returns during this remarkable period of performance. The largest positions described above delivered significant positive returns, while smaller positions in long risk assets like stocks and spreads (lumped together in ‘others’) created a drag. Some of the index return was missed (listed as unattributed) but the replication captured the vast majority of the return – providing an important stress test during an unusual period of market volatility.

The returns shown are for illustrative purposes only and do not represent the composition of any portfolio or account managed by Unlimited and available for investment by others. Simulated, backtested, modeled, or hypothetical performance results have certain inherent limitations and are for illustrative purposes only. Such results are hypothetical and do not represent actual trading, and thus may not reflect material economic and market factors, such as liquidity constraints, that may have had an impact on actual decision-making. Such results are also achieved through retroactive application of a model designed with the benefit of hindsight and cannot account for all financial risk that may affect actual performance. No representation is being made that any investor will or is likely to achieve results similar to those shown.