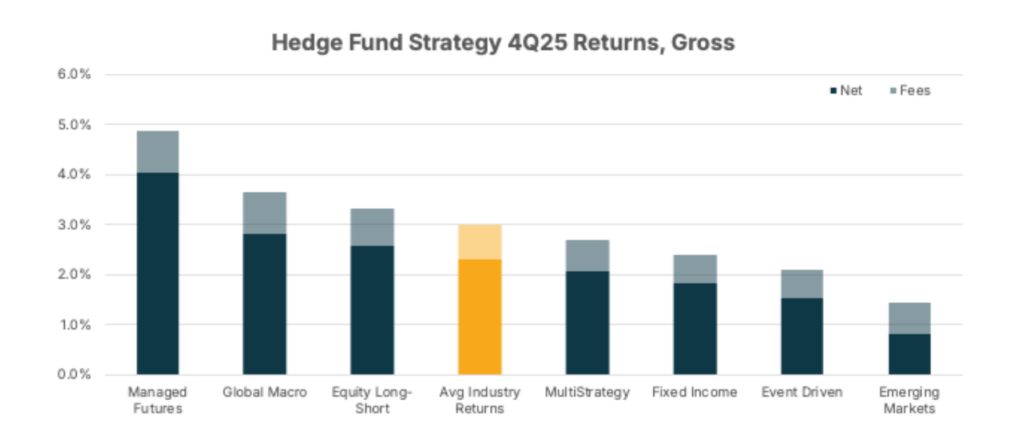

4Q 25 Hedge Fund Strategy Performance, Gross of Fees

- Industry Return: 3.0%

- Best Performing Fund Style: Managed Futures: 4.9%

- Worst Performing Fund Style: Emerging Markets: 1.4%

Summary Commentary

Hedge Funds delivered strong positive performance in Q4-25 with Managed Futures and Global Macro strategies benefitting from rallies in gold and ex-US equities while Emerging Markets strategies were modestly positive, challenged by geopolitical uncertainty.

Hedge Funds maintained their risk on positioning through the quarter, as concerns about debasement and an AI bubble increased. Managers rebalanced equity portfolios in Q4, reducing technology sector exposure and bolstering allocations to emerging markets. Long gold views continued to hold through the quarter.

Funds ended the year with risk-on positioning, with conviction in assets like gold and global equities.

Returns are depicted gross of fees. The lightened sections show the impact of inferred fees. See methodology at the end of this presentation for more details.

To read full report (pages 1-8) click here.