Report Highlights

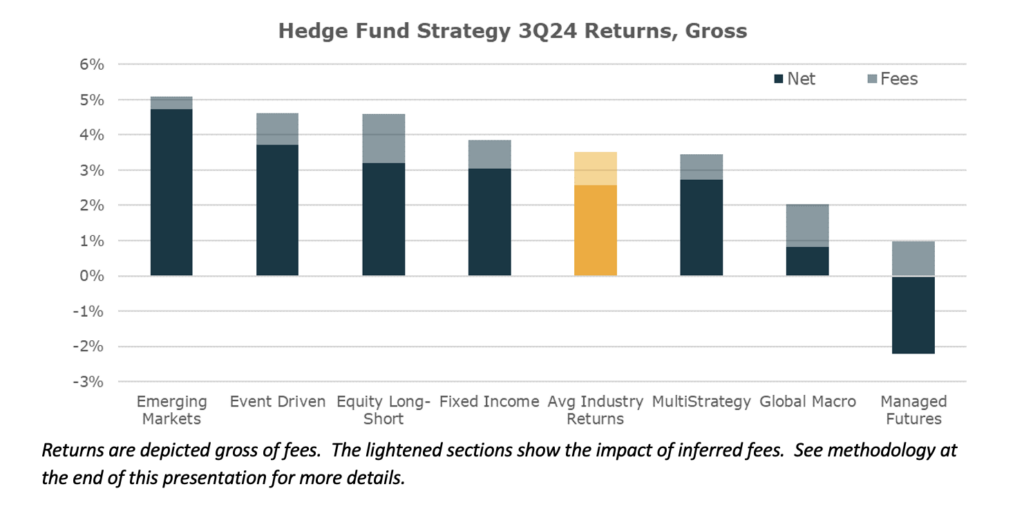

3Q 2024 Hedge Fund Strategy Performance, Gross of Fees

- Industry Return: 3.5%

- Best Performing Fund Style: Emerging Markets 5.0%

- Worst Performing Fund Style: Managed Futures -1.2%

Commentary

Hedge Fund performance in the third quarter was moderately positive, with Emerging Markets managers delivering 5% returns supported by a rally in Chinese assets at the end of the quarter. Long/Short Equity and Event Driven managers rode through the turmoil during the quarter to deliver positive returns as well Meanwhile Global Macro and Managed Futures managers’ performance was underwhelming as markets experienced heavy chop.

Despite the turbulence of August, Long/Short Equity managers continue to hold roughly normal levels ofoverall equity exposure, while continuing their rotation toward large cap growth stocks and away from small and mid-caps. Fixed income managers have started to trim their near peak exposure to corporate spreads, after their approach of levering up into secularly low spreads backfired in August as spreads rose.

Strategies which rely on following trends in economic stats and markets notably underperformed in the third quarter as many markets experienced heavy chop. By the end of the quarter these managers appear to be long assets seemingly positioned to benefit from cyclical easing of monetary policy.

You can read the full report (pages – 12) with additional context and market commentary here.