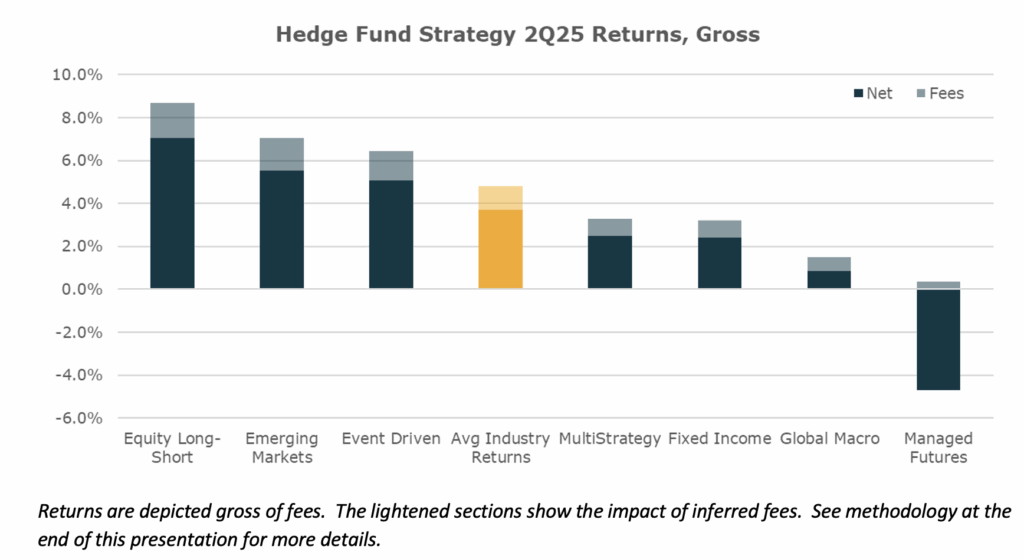

2Q 25 Hedge Fund Strategy Performance, Gross of Fees

- Industry Return: 4.8%

- Best Performing Fund Style: Equity Long/Short 8.7%

- Worst Performing Fund Style: Managed Futures -4.4%

Summary Commentary

Hedge Funds delivered moderately positive performance in 2Q25 with Equity Long/Short and Emerging Market strategies benefiting from strong global asset performance while Managed Futures strategies were negative, challenged by choppy market conditions.

Hedge Funds maintained relatively conservative positioning through the quarter given the significant policy volatility through the period. After shifting to underweight views on stocks and bond and long gold ahead of Liberation Day, managers shifted toward neutral as the impacts of the pause became clearer. Increasing short dollar views were one of the few trends across major markets that continued through the quarter and funds now appear moderately short USD.

Funds ended the second quarter with neutral positioning across most markets, with strong conviction in only a few places like short the USD, short small & midcap stocks, and long financials.

To read the full report details (pages 1-9) click here.